VA disability pay for 2026 is a monthly, tax-free benefit provided by the U.S. Department of Veterans Affairs to veterans with service-connected injuries or illnesses. These payments help offset lost earning capacity and rising living and medical costs related to military service. Eligible veterans should pay close attention to the 2026 updates, as the annual Cost-of-Living Adjustment (COLA) to VA disability compensation can directly impact household finances as inflation continues.

This guide breaks down the updated VA disability compensation rates for 2026, explains how dependents affect monthly payments, and outlines ways to increase your benefits with the right supporting evidence.

Table of Contents

How 2.8% COLA Increase Changed the VA Disability Pay for 2026

The most notable update to the VA disability increase 2026 is the 2.8% Cost-of-Living Adjustment confirmed for the year. This is an annual adjustment designed to protect veterans’ purchasing power as everyday costs rise. The Social Security Administration calculates COLA using the changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

For 2026, a 2.8% COLA increase was approved and automatically applied to VA disability compensation, with rates effective December 1, 2025, and reflected in January 2026 payments.

Impact on Monthly VA Compensation

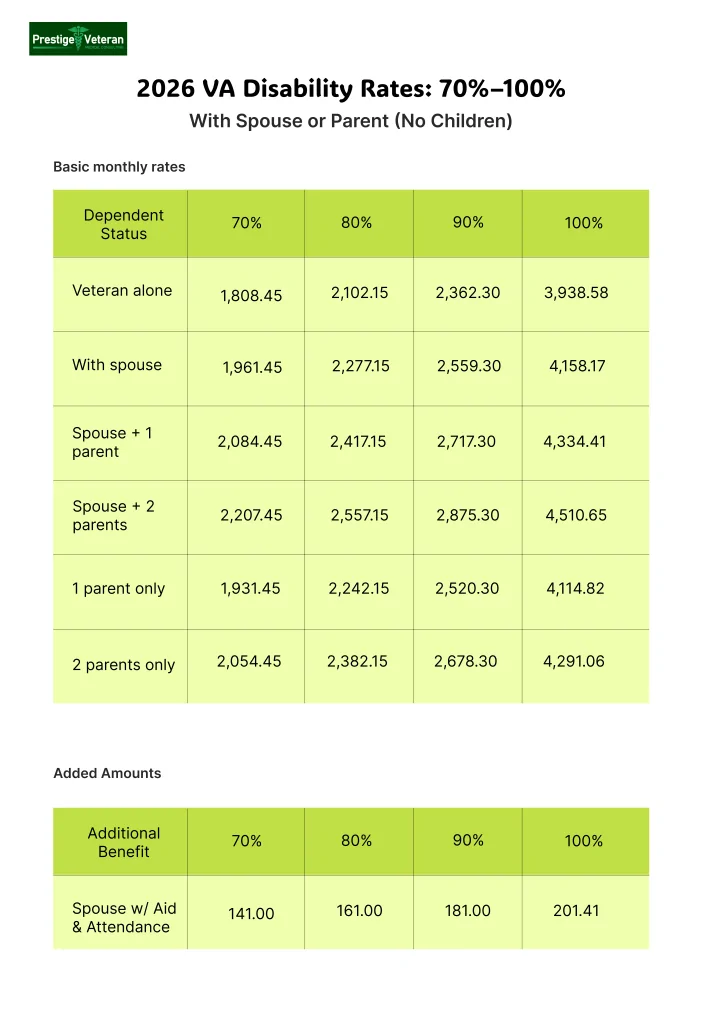

Compared to the 3.2% COLA in 2025, the VA Cost-of-Living Adjustment 2026 is slightly lower, yet monthly payments still increased for every disability rating from 10% to 100%. Veterans at lower ratings saw modest dollar increases, while those with higher disability ratings or qualifying dependents saw more noticeable gains due to higher base compensation.

For example, a veteran with a 70% disability rating saw their monthly compensation rise to about $1,808.45 in 2026 from roughly $1,759.19 in 2025, an increase of nearly $49 per month.

Overall, the VA COLA 2026 is an impactful annual adjustment for veterans living on fixed incomes that helps ease their financial burden of rising healthcare costs and family-related expenses.

Who Is Eligible for VA Disability Compensation?

Veterans may be eligible for VA disability compensation if they meet one or more of the following criteria:

- Have a service-connected injury or illness

- Developed a condition during service or after separation that was caused or aggravated by military service

- Served on active duty, in the Reserve, or in the National Guard

- Received a discharge under conditions other than dishonorable

Confirming your eligibility is especially important before reviewing the VA disability pay chart, as only veterans with approved service-connected ratings qualify for compensation. It also ensures you receive the correct disability percentage and the benefits you’re entitled to this year.

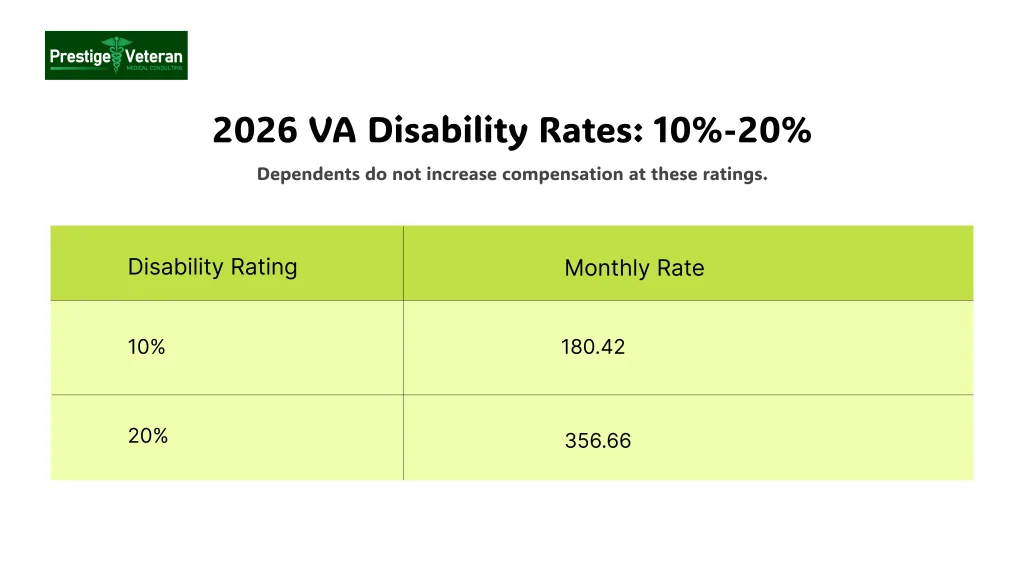

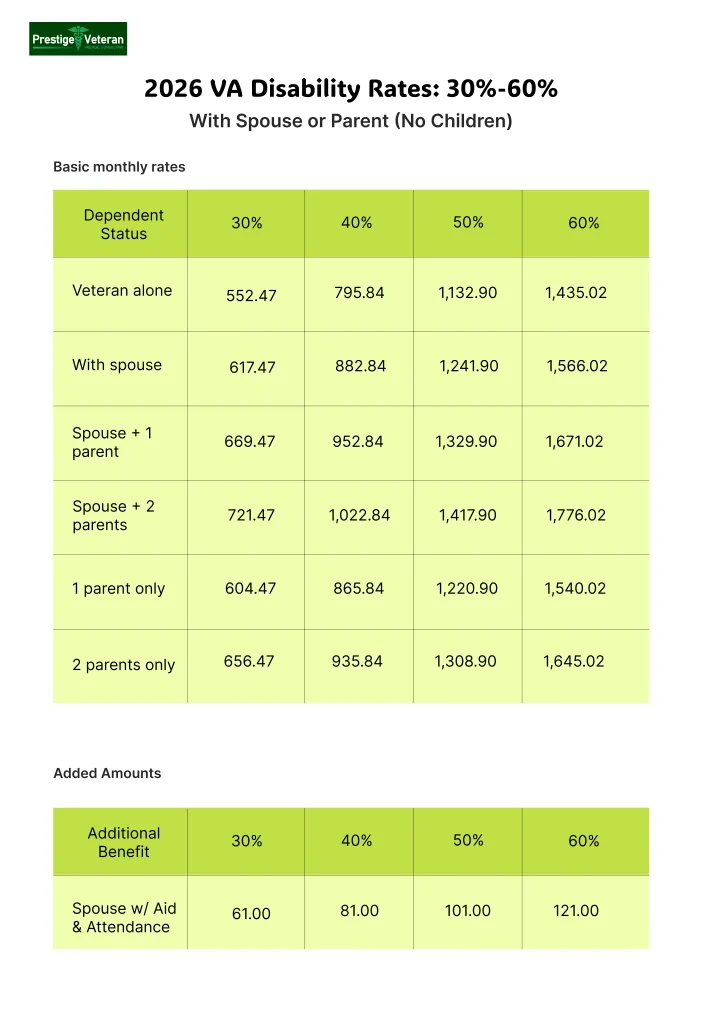

VA Disability Pay Chart 2026: Official Monthly Compensation Rates

The 2026 VA disability pay chart reflects updated monthly compensation amounts following the federally mandated Cost-of-Living Adjustment (COLA). These rates are effective December 1, 2025, with the increased payments first appearing in January 2026, since VA benefits are paid in arrears.

VA disability compensation is tax-free, paid monthly, and based primarily on two factors:

- Your combined disability percentage

- Whether you have eligible dependents such as a spouse, children, or parents

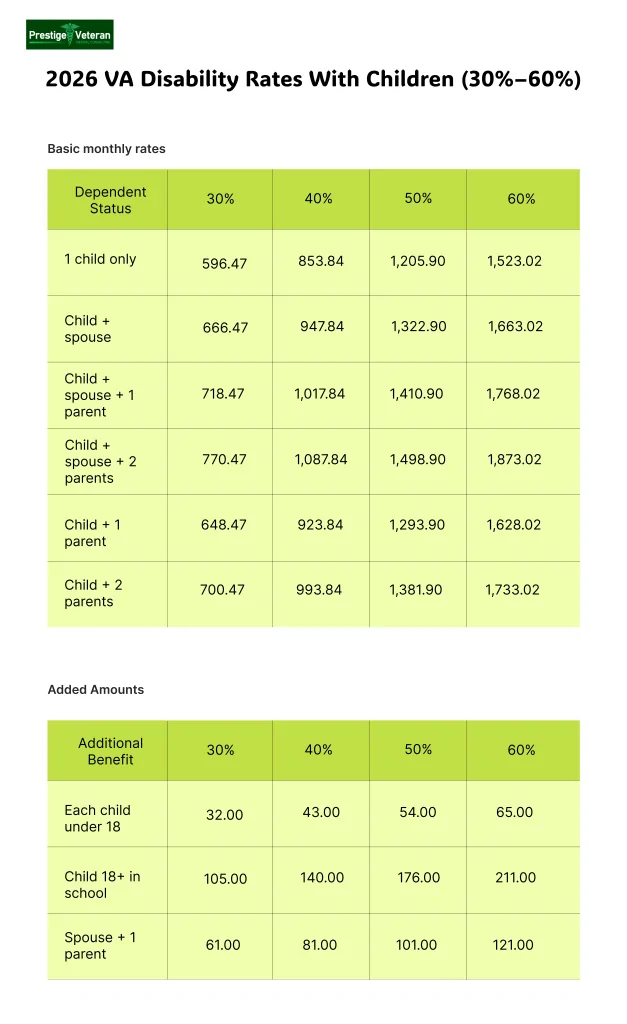

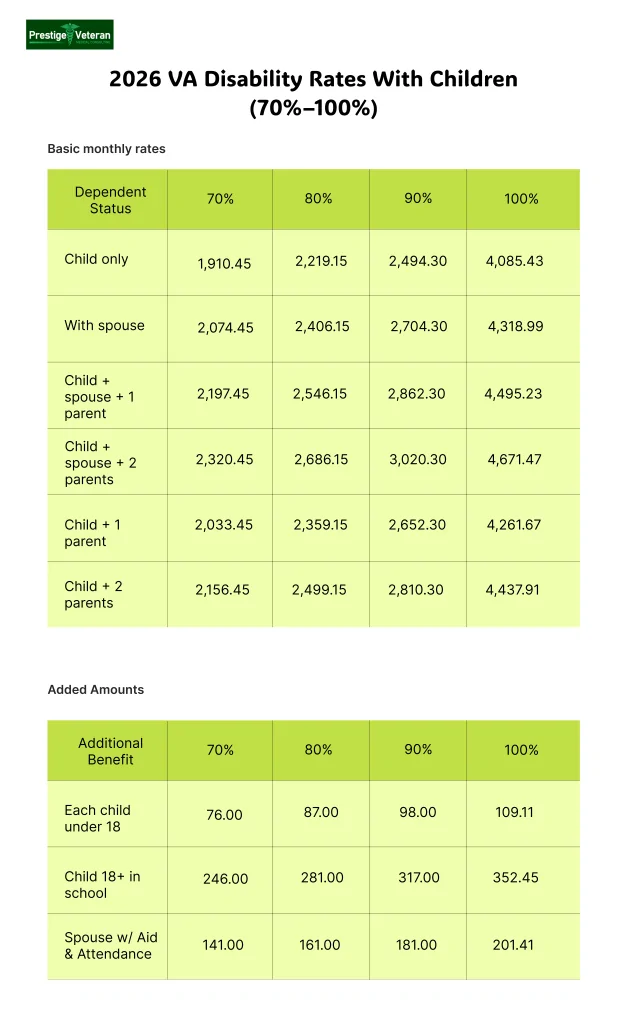

Veterans with lower ratings (10% or 20%) receive a flat monthly amount. For ratings of 30% or higher, compensation increases when dependents are added, and extra allowances may apply for children over age 18 in school or a spouse receiving Aid and Attendance.

Study the tables below to quickly estimate your expected VA disability compensation for 2026.

For the most accurate amounts, check the official compensation rate tables on VA.gov.

How to Estimate Your VA Disability Compensation

A veteran with a 60% VA disability rating lives with his spouse and two children under age 18.

- Looking at the 60% rating (Child + spouse) in the table, the basic monthly payment is $1,663.02.

- The tables also show an added amount for each child under 18 at 60%, which is $65.00.

Estimated Total monthly payment: $1,728.02

You can save or print this 2026 VA disability pay chart to plan your household finances and review any benefit updates.

VA Disability Pay Rates With Dependents

Dependents play a critical role in compensation once a veteran reaches a 30% disability rating. Below that threshold, dependency status does not affect payment amounts.

How Dependents Affect Compensation

- 10%–20% ratings: No additional pay for dependents

- 30%–100% ratings: Monthly compensation increases for eligible dependents

Breakdown by Household Type

- Veteran Alone: Receives the standard VA compensation rate tied to the disability percentage.

- Veteran With Spouse: Qualifies for higher monthly compensation starting at a 30% rating, with additional pay if the spouse requires Aid and Attendance.

- Veteran With Children: Extra monthly amounts are added per child only at ratings of 30% or higher, with increased totals for multiple dependent children.

- Veteran With Dependent Parents: Eligible for higher monthly compensation for dependent parents when the VA rating is 30% or above.

A veteran with a 20% disability rating is paid at the veteran-only rate, even if they have a spouse and children. When that same veteran’s rating increases to 30% after a successful appeal, the VA begins paying additional monthly benefits for the dependent spouse and children, resulting in thousands of dollars more in compensation.

How to File: To add or change dependents, provide proof such as a marriage certificate or divorce decree, children’s birth certificates or adoption papers, Social Security numbers, or proof of a dependent parent’s financial reliance on you. File the update by adding dependents through VA.gov, submitting VA Form 21-686c online, or by mailing it to the VA Evidence Intake Center.

How Your VA Disability Ratings Are Calculated

VA disability ratings are calculated by evaluating the measurable functional impact of each service-connected condition using the 38 CFR Part 4 — Schedule for Rating Disabilities. After medical evidence, service treatment records, and Compensation and Pension exam findings are reviewed, each condition receives a percentage rating in 10% increments from 0% to 100%. These percentages eventually decide your monthly compensation levels outlined in the VA disability pay chart 2026.

Calculation of VA Combined Rating

When a veteran has multiple service-connected conditions, the VA uses the Combined Ratings Table instead of adding percentages directly. The process starts with the highest-rated disability. The VA subtracts that percentage from full functional health, which is considered 100%. The next disability rating is then applied only to the remaining functional capacity. This calculation continues sequentially for all service-connected conditions before the final number is rounded to the nearest 10%.

For example, a former veteran is service-connected for chronic knee instability rated at 40% and tinnitus with hearing complications rated at 20%.

Step 1: Start with the Highest Disability Rating

- 40% disability

- Remaining health: 100% − 40% = 60%

Step 2: Apply the Second Disability to the Remaining Function

- 20% of 60 = 12%

Step 3: Add the Disability Percentages

- First disability: 40%

- Additional disability impact: 12%

- Combined value:

- 40% + 12% = 52%

Step 4: Round to the nearest 10%

- 52% rounds to 50% final combined disability rating

This step-by-step VA math demonstrates how combined ratings reflect cumulative functional loss rather than the simple addition of disability percentages.

TDIU Pay Rates in 2026 (Total Disability Based on Individual Unemployability)

TDIU or Individual Unemployability pays you at the 100% disability rate when your service-connected conditions prevent you from maintaining substantially gainful employment, even if your combined rating is lower.

Veterans typically qualify under schedular TDIU with:

- One disability rated at least 60%, or

- A combined rating of 70% with one condition at 40%.

Extraschedular TDIU may apply when ratings fall short, but medical and vocational evidence clearly shows unemployability. Most importantly, TDIU pays at the 100% compensation level (about $3,938.58 per month in 2026) yet differs from a schedular 100% rating, which is based solely on symptom severity rather than work capacity.

Veterans receiving TDIU generally must remain below the federal poverty threshold. Though marginal work, including certain part-time jobs or employment in a protected or sheltered environment, may still be eligible for this VA benefit.

Special Monthly Compensation (SMC) Rates for 2026

If you’re facing severe, service-connected disabilities requiring advanced care or resulting in major functional loss, VA Special Monthly Compensation (SMC) can provide you with additional tax-free benefits. Instead of your VA disability ratings alone, the eligibility for SMC benefits is based on your specific medical criteria and functional loss.

The 2026 VA SMC rates, adjusted for COLA increases, are paid on top of base compensation, acknowledging the deep functional impact severe disabilities have and helping veterans meet long-term needs.

Effective December 1, 2025, the SMC rates reflect the additional monthly compensation amounts payable based on qualifying SMC levels.

2026 SMC Monthly Payment (Veteran Alone – No Dependents)

| SMC Level | Monthly Rate (USD) | Qualifying Disabilities |

| SMC-K (Additive) | $139.87 | Loss of use of reproductive organ, limb, or sensory function |

| SMC-L | $4,900.83 | Loss of both feet, one hand and one foot, blindness, bedridden status, or need for Aid and Attendance |

| SMC-L ½ | $5,154.00 | Combination limb amputations or loss of use, severe visual/hearing combinations, or additional disabilities rated 50% or higher |

| SMC-M | $5,408.55 | Loss of both hands, knees, or severe vision loss paired with limb impairment |

| SMC-M ½ | $5,780.00 | Advanced limb amputations or loss of use, combined with total blindness and multiple severe disabilities |

| SMC-N | $6,152.64 | Loss of both arms near the shoulder, total blindness, or severe combined sensory impairments |

| SMC-N ½ | $6,514.00 | Catastrophic multi-disability conditions with additional qualifying impairments |

| SMC-O/P | $6,877.12 | Bilateral arm amputations, paralysis with loss of bowel/bladder control, or multiple SMC qualifying conditions |

| SMC-R.1 | $9,826.88 | Requires Aid and Attendance for daily personal care |

| SMC-R.2 / SMC-T | $11,271.67 | Requires skilled or constant supervision due to traumatic brain injury or severe paralysis |

| SMC-S | $4,408.53 | Housebound status due to service-connected disabilities |

| SMC-Q (In-Lieu) | $67.00 | Legacy protected payment replacing base compensation (not newly assigned) |

View the current, official VA Special Monthly Compensation (SMC) rates.

What are Additive vs. In-Lieu SMC Payments?

SMC payments may be either additive, meaning they are paid in addition to standard disability compensation or in lieu, which replaces the base compensation entirely.

Who is Eligible for SMC Benefits?

Veterans may qualify for SMC payments in 2026 if they experience:

- Loss or loss of use of a limb (hand, arm, foot, or leg)

- Loss of vision or blindness

- Permanent bedridden status

- Severe hearing loss combined with other disabilities

- Loss of reproductive organs or creative organs

- Need for regular Aid and Attendance (A&A) with tasks like eating, bathing, dressing, etc.

- Paralysis or neurological impairments

- Multiple severe service-connected disabilities

- Being permanently housebound due to service-connected disabilities

Additional payments may apply for qualifying dependents, including school-enrolled children, parents, or spouses requiring A&A, ensuring SMC supports overall caregiving and household needs.

2026 VA Disability Payment Schedule: When Will Veterans Get Paid?

VA disability compensation is paid on the first business day of the following month. If that day falls on a weekend or holiday, payments arrive early, that is, on the last business day of the prior month. This structure explains why some months have two deposits while others have none.

Knowing the VA disability payments 2026 schedule allows veterans to budget confidently and plan around early or delayed deposits. The schedule below reflects official payment timing used by the U.S. Department of Veterans Affairs and incorporates holiday and weekend adjustments.

2026 VA Disability Pay Dates (Month-by-Month)

| Benefit Month | Expected Payment Date | Day of the Week | Payment Timing Insight |

| December 2025 | December 31, 2025 | Wednesday | Issued early due to New Year’s Day |

| January 2026 | January 30, 2026 | Friday | Paid early as Feb 1 is a Sunday |

| February 2026 | February 27, 2026 | Friday | Early deposit because March starts on a Sunday |

| March 2026 | April 1, 2026 | Wednesday | Standard payment timing |

| April 2026 | May 1, 2026 | Friday | Regular schedule |

| May 2026 | June 1, 2026 | Monday | Regular schedule |

| June 2026 | July 1, 2026 | Wednesday | Regular schedule |

| July 2026 | July 31, 2026 | Friday | Early payment due to the weekend |

| August 2026 | September 1, 2026 | Tuesday | Regular schedule |

| September 2026 | October 1, 2026 | Thursday | Regular schedule |

| October 2026 | October 30, 2026 | Friday | Paid early as Nov 1 is Sunday |

| November 2026 | December 1, 2026 | Tuesday | Regular schedule |

| December 2026 | December 31, 2026 | Thursday | Early payment for New Year’s Day |

Note: Most VA disability payments show up in your account within 15 days of the rating decision date. Veterans enrolled in direct deposit receive funds faster. If the payment hasn’t arrived after 15 days, contact the VA at 800-827-1000.

What Is VA Disability Back Pay and When Do Veterans Receive It?

In addition to monthly payments, some veterans may receive back pay. VA disability back pay is a retroactive compensation owed to veterans for the period they met eligibility requirements but had not yet been paid.

The back pay amount is determined by the claim’s effective date, usually the later of the following:

- The date the VA received the claim (or intent to file) or

- The date entitlement arose based on medical or service evidence

If a claim is filed within 1 year of separation from service, the effective date may be as early as the day after discharge. Retroactive pay typically covers the time between the effective date and the decision date, and is issued as a lump-sum payment once the claim is granted. After retroactive benefits are paid, monthly disability compensation then continues at the assigned rating.

Tip: To lock in an earlier effective date, file an Intent to File (VA Form 21-0966) as you gather the evidence supporting your VA disability claim.

Strategies for a Higher VA Disability Rating and Compensation

Improving a VA disability rating often depends on taking the right actions at the right time and presenting clear, well-documented supporting evidence. While every situation is unique, some veterans choose to consult accredited attorneys or representatives to better understand the process and their options. Below are a few commonly discussed approaches that may help strengthen a claim and potentially maximize compensation.

1. File for an Increased Rating When Symptoms Worsen

When a service-connected condition appears to progress, veterans may consider requesting a reevaluation by filing for an increased rating using VA Form 21-526EZ. The VA may schedule a new Compensation and Pension (C&P) exam to review any changes in symptoms. In many cases, updated treatment records, imaging, physician statements, and functional assessments are referenced to show how a condition affects mobility or the ability to work. Some veterans also choose to speak with accredited attorneys or representatives to better understand the process and documentation involved, though each individual’s situation and approach can differ.

2. Considering Secondary Service-Connected Conditions

Under 38 CFR § 3.310, conditions caused or aggravated by an existing service-connected disability can receive separate ratings. For instance, depression related to chronic pain, sleep apnea linked with PTSD, or nerve damage secondary to orthopedic injuries. Establishing these secondary service connections can raise the combined rating and total compensation.

3. Consider Options to Challenge Rating Decisions Through Appeals and Supplemental Claims

If a claim is denied or rated lower than expected, veterans may consider available review options such as filing a supplemental claim with new and relevant evidence, requesting a Higher-Level Review, or pursuing a Board appeal. These pathways are generally used to address potential errors, overlooked medical findings, or incomplete evaluations. Discussions around appeals often emphasize the importance of clear, well-documented evidence aligned with VA rating criteria. Because each case is different, some veterans choose to seek general information from accredited attorneys or representatives, while others refer directly to official VA resources, including the VA decision review page, to better understand the process.

4. Strengthen Your Evidence With Medical Nexus Letters

A strong nexus letter from a qualified medical professional should clearly state that the condition is “at least as likely as not” (a 50% or greater probability) related to military service or to another service-connected disability. This type of medical evidence helps resolve uncertainty in the veteran’s favor. Well-supported nexus letters are often decisive in both primary and secondary claims because they fulfill the VA’s service-connection requirement.

5. Consider TDIU or Special Monthly Compensation (SMC)

In some cases, VA disabilities may help you receive benefits beyond standard schedular ratings. Total Disability based on Individual Unemployability can pay you at the 100% rate when steady employment isn’t possible. If you’re suffering from severe disabilities or need aid and attendance, filing for SMC may further increase your monthly compensation.

Seeking help from a VA-accredited representative, claims agent, or veterans service organization (VSO) can make the process clearer and help ensure your claim is properly developed and supported.

Additional VA Benefits for Veterans and Their Dependents

On top of monthly disability payments, the Department of Veterans Affairs offers several programs that ensure long-term financial stability, health care, housing, and education for veterans and their families. These VA benefits are especially important for veterans with a Permanent and Total (P&T) status, a 100% schedular rating, TDIU, or eligibility for Special Monthly Compensation.

You or your dependents may be eligible for additional VA benefits, such as:

- Dependency and Indemnity Compensation (DIC): A tax-free monthly payment, currently starting at about $1,699.36 per month in 2026, paid to surviving spouses, children, or parents when a veteran’s death is service-connected or occurs while rated totally disabled for a qualifying period.

- CHAMPVA Health Coverage: Provides medical coverage for eligible spouses and dependents when a veteran is permanently and totally disabled, covering many services similar to private health insurance.

- Dependents’ Educational Assistance (Chapter 35): Offers monthly payments for college, vocational training, apprenticeships, and certification programs, helping dependents build careers.

- Specially Adapted Housing (SAH) and Home Adaptation Grants: Financial assistance to modify homes with ramps, widened doorways, or accessible bathrooms for veterans with severe mobility impairments.

- Automobile and Adaptive Equipment Benefits: One-time grants and ongoing assistance to help purchase or modify vehicles for veterans with service-connected disabilities affecting mobility or vision.

- VA Health Care Priority Enrollment: Veterans with service-connected disabilities may receive priority access to VA medical care, specialty treatment, rehabilitation, and preventive services at reduced or no cost.

- Survivors’ Pension: Needs-based financial support for low-income survivors of wartime veterans, with higher payments available for A&A or housebound status.

- VA-backed Home Loan Benefits: Helps eligible surviving spouses buy, build, or refinance homes with no down payment in many cases, competitive rates, and possible funding fee exemption.

It is encouraged to review your eligibility for these programs annually or consult a VA-accredited representative.

Conclusion

The 2026 VA disability compensation rates continue to financially support veterans as living expenses inflate. Although the COLA increase may seem modest, even small adjustments can provide meaningful help over time, especially for those caring for dependents or managing long-term health conditions. Veterans are encouraged to review their disability ratings periodically, keep medical records up to date, and report any changes in dependent status to ensure they receive the full benefits they deserve. When in doubt, reaching out to accredited representatives or veterans service organizations can help avoid delays and strengthen claims for fair compensation.

Frequently Asked Questions (FAQs)

Is there a VA disability increase for 2026?

Yes, a 2.8% Cost-of-Living Adjustment (COLA) for 2026 was approved and automatically added to VA disability payments.

What is the maximum VA disability payment in 2026?

The maximum VA disability payment in 2026 is about $4,671.47 per month, which applies to a 100% disability rating with a spouse, two parents, and a child.

What is the DIC rate for 2026?

The base Dependency and Indemnity Compensation (DIC) rate for a surviving spouse in 2026 is about $1,699.36 per month, with higher amounts possible depending on children or other qualifying factors.

How much compensation does a 100% disabled veteran get a month?

According to the VA disability pay chart, a veteran rated 100% disabled receives about $3,938.58 per month (veteran alone, no dependents) in 2026.

Will the VA military and Social Security recipients receive a 2.8% COLA increase in 2026?

Yes, official announcements confirm that Social Security and related benefits received a 2.8% cost-of-living adjustment for 2026, and the same COLA also adjusted VA disability compensation.

What are the VA disability pay rates for 2026 with a spouse?

VA monthly compensation increases at all ratings of 30% or higher when a spouse is included. For example, about $617.47 at 30%, $1,566.02 at 60%, and $4,158.17 at 100% for a veteran with a spouse and no children.

On what basis does the VA assign a disability rating?

To determine a rating, the VA examines medical evidence, service history, and C&P examination results, assigning a percentage that reflects the severity of the condition and how much it affects your ability to function and work.

Also Read: Veterans COLA 2026: New Rates and How They Affect You

At Prestige Veteran Medical Consulting, a veteran-owned company, we specialize in Independent Medical Opinions (IMOs) known as Nexus letters.

Our purpose is to empower YOU, the veteran, to take charge of your medical evidence and provide you with valuable educational tools and research to guide you on your journey.

Understanding the unique challenges veterans face, our commitment lies in delivering exceptional service and support.

Leveraging an extensive network of licensed independent medical professionals, all well-versed in the medical professional aspects of the VA claims process, we review the necessary medical evidence to incorporate in our reports related to your VA Disability Claim.

Prestige Veteran Medical Consulting is not a law firm, accredited claims agent, or affiliated with the Veterans Administration or Veterans Services Organizations. However, we are happy to discuss your case with your accredited VA legal professional.