VA disability back pay is the compensation granted by the Department of Veterans Affairs (VA) to reimburse veterans for the time they waited for their disability benefits to be approved. This retroactive payment ensures veterans are fully compensated for their service-connected conditions from the correct effective date. While the VA’s back pay system can seem complicated, understanding the essentials, like when payments start and how eligibility is determined, can make a major difference.

This blog details everything veterans need to know about how VA disability back pay works, how it’s calculated, and what factors can delay processing. Also, discover what steps can help secure the maximum retroactive compensation possible.

Table of Contents

What Is VA Disability Back Pay?

Back pay, also called retroactive pay, is the lump-sum compensation the VA owes a veteran for the period they were eligible for disability benefits but had not yet received them, as their claim was still under review. Because the VA takes months or even years to process claims and appeals, back pay ensures veterans are not financially penalized while waiting for a decision.

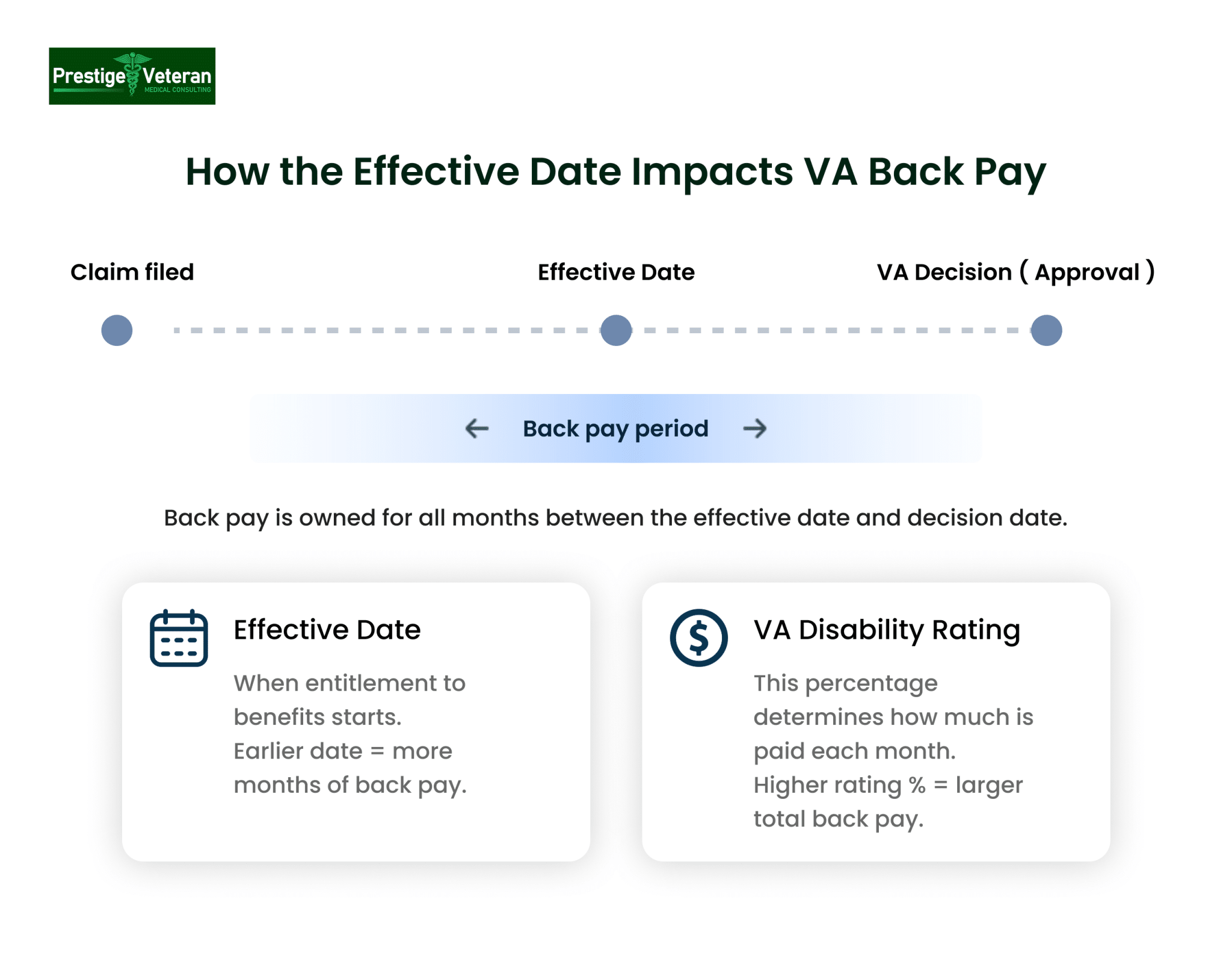

The VA retroactive compensation a veteran receives depends on two primary factors:

- Effective Date: When the veteran’s entitlement to benefits started

- VA Disability Rating: The percentage assigned by the VA that determines the monthly compensation amount, as governed by 38 C.F.R. Part 4 – Schedule for Rating Disabilities.

How Does VA Back Pay Work?

Back pay starts from the effective date of the claim, which is usually the date the VA received your application or the date entitlement arose and continues up to the date the VA officially grants the claim. Your VA disability rating also directly impacts back pay. The higher the awarded rating, the higher the monthly payment and the greater the retroactive amount owed. Once approved, the VA generally issues back pay in one lump sum, sent directly to the veteran’s bank account.

To calculate the total back pay amount, the VA adds up each month of missed compensation, taking into account historical changes such as Cost-of-Living Adjustments (COLA) and changes in dependent status or disability rating.

Most importantly, VA disability back pay is tax-free, allowing veterans to receive the full amount they are owed for their service-connected conditions.

What Is an Effective Date and Why Does It Matter?

In a VA disability claim, an effective date determines how far back your VA back pay goes. Securing the earliest possible effective date protects your right to the maximum retroactive compensation.

In most cases, the effective date is either:

- The day the VA received your claim

- The day entitlement to benefits arose (such as the date of diagnosis or documented worsening of a condition).

- For veterans who file within 1 year of leaving active duty, the effective date can be the day after discharge, which can mean thousands more in retroactive compensation.

- The date new evidence was received by the VA (for rating increase claims)

Effective date rules may change when veterans request higher ratings, add dependents, appeal a denied claim, or correct VA’s errors, which can impact how much back pay they receive.

Because even a small shift in the effective date can cost months or years of benefits, veterans should always review VA decision letters carefully. If the effective date appears incorrect, filing an appeal may be helpful to secure the full back pay they rightfully earned through service.

For more details, see 38 C.F.R. Part 3, Subpart A – General Rules for Effective Dates.

How Is VA Disability Back Pay Calculated?

The VA calculates the VA back pay by determining the gap between the effective date and the date the award is granted, then multiplying the owed months by the correct disability rate for each year. VA back pay is paid as a lump sum, usually within 15–45 days after your claim is approved.

Typically, the VA uses the following to calculate your retroactive payment:

- Effective Date – The day when VA should have started paying disability benefits.

- Monthly payment rate: Based on your VA disability rating (0% to 100%) and number of dependents, the VA applies the historical VA disability pay rates that were in effect for each year of your retroactive period.

- Duration: Total number of months between your effective date and the approval date.

- Annual COLA (Cost of Living Adjustments): VA disability compensation rates already reflect annual COLA increases.

- Dependency status: Spouse, children, and dependent parents increase your monthly rate.

- Staged ratings – Changes in disability rating over time can affect the retroactive amount.

How Back Pay is Calculated:

- Step 1: The VA confirms your effective date

- Step 2: Count the number of unpaid months through approval

- Step 3: Multiply each month by the appropriate historical compensation rate for your rating and dependent status

- Step 4: Subtract any payments already received

- Step 5: VA pays the total as a lump sum payment through direct deposit

You can use an online VA back pay calculator to stay informed of every dollar of compensation you’re owed and spot any missing benefits.

Example Calculation:

Case 1: Single Veteran with No Dependents

A Veteran with no dependents is awarded a 50% disability rating effective January 1, 2022. The VA issues the decision on January 1, 2024, resulting in 23 months of unpaid compensation.

Effective date: Jan 1, 2022

Decision date: Jan 1, 2024

Months owed: Feb 2022 → Dec 2023 = 23 months

Payments (accrual) begin the month after the effective date and end the month before the decision month.

Rates:

- 2022 (11 months): 50% single = $958.44 per month

- 2023 (12 months): 50% single = $1,041.82 per month

Back pay: (11 × 958.44) + (12 × 1,041.82) = $23,044.68

Case 2: Veteran with Two Dependent Parents

A Veteran with two dependent parents is awarded a 60% disability rating effective July 1, 2021. The VA issues the decision on July 1, 2023, resulting in 23 months of retroactive entitlement.

Effective date: Jul 1, 2021 → accrual starts Aug 1, 2021

Decision date: Jul 1, 2023

Months owed: Aug 2021 → Jun 2023 = 23 months

Rates (two parents, no spouse/children, 60% rating):

- 2021 (Aug–Dec, 5 months): $1,314.39 per month

- 2022 (Jan–Dec, 12 months): $1,392.03 per month

- 2023 (Jan–Jun, 6 months): $1,513.65 per month

Back pay: (5 × 1,314.39) + (12 × 1,392.03) + (6 × 1,513.65) = $32,358.21

Case 3: Veteran Filing Late After Discharge

A Veteran filed a claim two years after discharge and was awarded a 30% disability rating with no dependents. The claim was filed on February 1, 2022, and the decision was issued on April 1, 2024, resulting in 25 months of VA back pay.

Effective date: February 1, 2022 → payment starts March 1, 2022

Decision date: April 1, 2024

Months owed: Mar 2022 → Mar 2024 = 25 months

Rates (single, no dependents):

- 2022 (Mar–Dec, 10 months): 30% = $467.39 per month

- 2023 (Jan–Dec, 12 months): 30% = $508.05 per month

- 2024 (Jan–Mar, 3 months): 30% = $524.31 per month

Back pay: (10 × 467.39) + (12 × 508.05) + (3 × 524.31) = $13,769.73

Note: Because the claim was filed more than one year after separation, VA uses the filing date as the effective date and not the separation date. This is why timely filing matters.

Factors That Affect the VA Back Pay Timeline

While veterans are entitled to retroactive payments based on the effective date of their claim, several factors can impact how long it takes to receive those funds.

1. Filing After Service Separation

The VA uses your effective date to determine when your disability pay begins and how much back pay you receive. When veterans file their initial VA claim more than a year after leaving active duty, they lose access to the earliest possible effective date and get reduced retroactive benefits.

- Filing within one year of separation allows your effective date to start the day after service discharge, ensuring the highest possible back pay.

- Filing after one year sets the effective date to the day the VA receives the claim, reducing eligible retroactive compensation.

Filing a VA disability claim within that one-year window protects the maximum compensation you have earned.

2. Claim Type: Direct, Secondary, or Presumptive Service Connection

Each type of service connection claim has different rules for setting effective dates, which directly impact the timeline for back pay.

- Direct or Secondary Claims: Effective date is the claim-filing date or the date entitlement arose due to service or a service-connected disability, whichever is later. If you file within 1 year of separation, the effective date may be the day after discharge.

- Presumptive Claims: If you filed within 1 year after service for some conditions, the effective date is when a toxic exposure condition (e.g. Agent Orange, Gulf War, Burn Pit) was diagnosed. If filed after, it’s the claim filing date or the entitlement date, whichever is later.

- Nehmer Agent Orange Claims: Under the Nehmer ruling, Vietnam-era veterans exposed to Agent Orange may have their effective date moved back to the original claim if a previously denied condition was later recognized as herbicide-related.

Example: A veteran diagnosed with direct service-connected arthritis in 2015 but filing a claim in 2020 will only receive back pay from 2020, not the original diagnosis date, because the claim was filed more than a year after service.

Filing outside these criteria shifts the effective date forward, potentially reducing your total VA disability retroactive payment.

3. Claims for VA Disability Rating Increases and Reductions

If you’re already service-connected and your condition worsens, the effective date for increased compensation depends on when the VA receives the claim. However, if medical evidence shows the condition worsened within one year prior to filing, the VA can backdate to the actual worsening event.

Example: If a veteran files for a rating increase in February 2025 with treatment records showing their back injury worsened in May 2024, the VA may grant back pay starting from May 2024.

For VA rating reductions, the VA first issues a proposal and, if finalized after due-process, the effective date will follow the notice period of 60 days, which can reduce monthly benefits and cut off future back pay. Failing to file timely or lacking clear evidence can lead to a later effective date, delaying the VA back pay timeline.

4. Supplemental Claims

For previously denied claims that are later supplemented, the VA preserves the original effective date if filed within a year of the prior decision.

If filed after one year of the decision, the effective date is when VA receives that claim (or when entitlement arose), unless the new evidence proves the condition existed earlier.

Example: A veteran denied for migraines in 2015 files a Supplemental Claim in 2021 with new service treatment records, so back pay starts from the 2021 filing date unless that new evidence shows an earlier onset.

Thus, a delay in reapplying can cost veterans months or even years in lost compensation.

5. Higher-Level Review Claims

A Higher-Level Review keeps the original effective date because the VA re-evaluates the same evidence, not new submissions.

Example: A veteran denied for back pain in 2022 requests an HLR within the year, and when granted, their back pay is calculated from the 2022 claim date.

6. Board of Veterans’ Appeals (BVA) Decisions

While appealing a denied VA claim can ultimately result in a favorable decision, the process adds significant delays. The BVA may take over 2 years to decide, but if the appeal is continuously pursued, back pay is calculated from the original filing date.

Example: When a veteran is denied service connection for PTSD in 2019, appeals directly to the BVA, and wins in 2023, their back pay is calculated from the 2019 original claim date because the appeal remained active.

7. Complexity of Claims and Number of Disabilities

The more complex your case or the more conditions you’re claiming, the longer it generally takes for VA to decide, which in turn delays the disbursement of back pay. For example, Fully Developed Claims (FDCs) with multiple issues average around 150 days, while Board Appeals can take up to 730 days, depending on the docket type. This waiting period does not affect how much back pay you’re owed, but it does postpone when you receive it.

8. Delays in Medical Evidence or Claim Development

Lack of immediate, credible medical evidence can stall claim development and delay the assignment of an effective date. Whether it’s a delay in obtaining DBQs (Disability Benefits Questionnaires), service records, or nexus opinions, every day VA spends developing the claim postpones the start of benefits. In some cases, late-submitted evidence can alter the effective date, particularly if it shows the disability worsened or began earlier than initially claimed.

9. Submission of Dependent Status

Veterans with a 30% rating or higher may be eligible for VA compensation retroactive payment that includes dependents. However, if dependents weren’t listed or the required form wasn’t submitted, retroactive VA disability payments won’t include those family members. Veterans who later submit their form may only receive VA backpay for dependents from the date that the form was filed, unless submitted within a year of the decision.

10. Special Monthly Compensation (SMC) and Aid & Attendance Claims

For SMC or Aid and Attendance, back pay depends on when the VA determines the veteran became eligible and not just when the claim was filed. If supporting evidence clearly shows the need for enhanced benefits began earlier, the effective date and corresponding back pay may reflect that date of entitlement. Without timely and sufficient documentation, however, benefits start from the claim date, reducing VA retroactive pay.

11. Clear and Unmistakable Error (CUE) or Difference of Opinion

If a prior decision is overturned due to CUE, the effective date reverts to the original claim date as though the error never occurred, resulting in substantial back pay. However, identifying and proving such errors takes time and often requires a skilled review or legal input, extending the back pay timeline significantly.

A favorable “difference of opinion” ruling initiated by the VA can also result in retroactive compensation, but it often depends on complex internal decisions.

12. Liberalizing Law or Regulation Changes

When VA rules change to favor veterans’ disability compensation (e.g., adding new presumptive conditions), your back pay depends on when you file in relation to the rule change.

- If you file within 1 year of the regulation taking effect, the effective date may be the day the rule changed.

- However, filing after 1 year of the regulation change shifts the effective date to one year prior to the filing date at best, delaying or reducing your retroactive compensation.

13. PACT Act-Related Claims

VA disability claims filed under the Honoring our Promise to Address Comprehensive Toxics (PACT) Act of 2022 follow a unique backdating rule. If your PACT-related claim was submitted before August 10, 2023, your effective date defaults to August 10, 2022, the date the law was enacted. But any claim filed after that deadline starts from the actual filing date, eliminating up to a year’s worth of potential back pay.

14. Claims Related to Hospitalization or Medical Events

If a veteran suffers an injury or worsened condition during a VA hospital stay, or in cases of death, the claim must be filed within one year for the effective date to reflect the incident date. Filing outside that window shifts the effective date forward to when the claim is received. This delay often happens unintentionally due to recovery time or lack of awareness, resulting in lost VA disability retroactive payment.

15. Dependency and Indemnity Compensation (DIC) Claims

For surviving spouses or dependents, DIC benefits can be retroactive to the first day of the month the veteran’s death occurred, but only if the claim is filed within one year of the service-related death. Filing after that results in the effective date being the claim receipt date, potentially losing up to a full year or more of back pay. This is a common issue in delayed VA survivor claims.

How to Get Back Pay for Dependents

Veterans who receive a VA disability rating of 30% or higher are eligible for additional monthly compensation for their dependents. Dependents eligible for added benefits include:

- A spouse, including same-sex or legally recognized common-law partners

- Biological, adopted, or stepchildren under 18

- Children ages 18–23 enrolled full-time in school

- Dependent parents who rely on the veteran financially

- Adult children with permanent disabilities

According to 38 CFR § 3.401(b), the effective date for adding dependents is generally the date of marriage, birth, or adoption if proof is provided within one year, or otherwise, the later of the date dependency arose or the date the VA was notified of the veteran’s disability rating.

To receive back pay for VA dependents, the veteran must:

- Include dependents on the initial claim

- Submit VA Form 21-686c (Declaration of Status of Dependents)

- Ensure dependents were eligible during the entire retroactive period

Important: If you submit the dependent form more than one year after the qualifying event or rating decision, back pay is only calculated from the date of the form submission, not your claim’s effective date.

When and How Is VA Back Pay Paid?

Once your disability claim is approved, the retroactive pay is typically issued in one lump sum within 15 to 45 business days. Remember, VA back pay is tax-free and intended to make up for the compensation you should have received earlier.

Here are key details:

- Payment Method: Electronic Funds Transfer (EFT) directly to your bank account on file

- Check eBenefits or VA.gov to track payment status and verify banking information

- Contact VA at 800-827-1000 for payment delays or errors

In cases involving VA appeals, large back pay amounts, DFAS audits (for retired pay offsets), and other complexities, issuance of retroactive payment may take 15 to 60 days or longer.

You can also seek help from a Veterans Service Organization (VSO) or accredited representative.

Tips to Maximize Your VA Disability Back Pay

Securing every dollar of back pay starts with protecting your earliest possible effective date and ensuring the VA has the right evidence to accurately rate your condition.

Here are some factors to get the most from your back pay that you and/or your accredited legal professional may consider:

- File Now or Submit an Intent to File – Filing your claim right away or submitting an Intent to File protects the earliest effective date and can add up to 12 months of additional VA back pay.

- Appeal Denials on Time – If denied, file a timely appeal or review to preserve your original effective date, as submitting after one year often resets the clock and can erase years of owed compensation.

- Include Strong Medical Evidence – Medical records proving when your disability began or worsened may help the VA set an earlier effective date and boost your retroactive pay.

- Add Dependents Correctly – Submit Form 21-686c early to include your spouse, children, or dependent parents and ensure dependent back pay.

- Check Your VA Award Letter for Errors – Review your disability ratings and effective dates thoroughly, and if the VA made a clear and unmistakable error, filing a CUE claim can recover years of lost back pay.

- Respond Fast to VA Requests – Attending Compensation and Pension (C&P) exams and responding to VA requests for evidence on time prevents delays that push back your disability decision and payment.

By staying proactive, verifying every detail, and responding quickly throughout the VA claims process, you can secure every dollar of compensation you have earned.

Final Thoughts

Receiving VA disability back pay can make a significant difference in a veteran’s financial stability and recognition for their service-connected conditions. While the process may take time, patience and attention to detail can help veterans receive every dollar owed. Veterans should review every decision carefully, appeal when necessary, and file claims soonest to preserve the earliest possible effective dates.

If your effective date seems incorrect or your payment appears lower than expected, don’t hesitate to review your decision letter or seek help from a Veterans Service Organization. Above all, staying informed and proactive ensures you receive the full VA back pay you rightfully deserve.

Frequently Asked Questions (FAQs)

Will I get back pay for VA disability?

Yes, if your disability claim is granted, VA back pay is paid from the effective date to the approval date.

How is backpay calculated for disability?

Back pay is calculated based on the number of unpaid months from your effective date to approval, multiplied by the correct historical monthly compensation rates.

What is the largest VA back pay amount?

There is no set maximum because back pay depends on how early the effective date is and the assigned disability rating.

What does the effective date mean for VA disability claims?

The effective date is when the VA determines your entitlement to benefits began, often the date the claim was filed or the date the disability was confirmed, which determines how far back your pay goes.

When will I get my VA disability back pay?

Most veterans receive their tax-free back pay in a lump sum within 15–45 days after VA claim approval.

Does VA backpay from intent to file (ITF)?

Yes, submitting an Intent to File can preserve an earlier effective date, triggering retroactive benefits dating back to that intent date if you submit the full claim on time.

How to get maximum back pay for VA disability?

Considerations for back pay:

- File as early as possible

- Appeal denials on time

- Include medical evidence showing when your condition began or worsened

- Correctly add dependents on time

- Review errors in effective dates

How do I check the status of my VA disability back pay?

You can check the status through VA.gov or eBenefits and call 800-827-1000 if there are concerns.

Do I get back pay for a VA disability rating increase?

Yes, if the VA grants a rating increase, you receive back pay from the effective date, showing when the condition worsened.

Also read: Who Qualifies as a VA Dependent? Here’s How to Apply for Benefits

At Prestige Veteran Medical Consulting, a veteran-owned company, we specialize in Independent Medical Opinions (IMOs) known as Nexus letters.

Our purpose is to empower YOU, the veteran, to take charge of your medical evidence and provide you with valuable educational tools and research to guide you on your journey.

Understanding the unique challenges veterans face, our commitment lies in delivering exceptional service and support.

Leveraging an extensive network of licensed independent medical professionals, all well-versed in the medical professional aspects of the VA claims process, we review the necessary medical evidence to incorporate in our reports related to your VA Disability Claim.

Prestige Veteran Medical Consulting is not a law firm, accredited claims agent, or affiliated with the Veterans Administration or Veterans Services Organizations. However, we are happy to discuss your case with your accredited VA legal professional.