Last Updated on 24 July, 2025

The passing of a 100% disabled veteran spouse brings emotional hardship and uncertainty about the future. Fortunately, the Department of Veterans Affairs (VA) provides extensive benefit programs to help surviving spouses honor their legacy and maintain financial, medical, and educational support. A total of $137 billion in VA benefits was awarded last year, including $127 billion in compensation and pension benefits to Veterans and survivors.

This guide offers a thorough breakdown of the benefits available to the surviving spouses of 100% disabled veterans, including eligibility requirements, benefit amounts, and how to apply.

Table of Contents

Who Qualifies as a 100% Disabled Veteran?

A 100% disability rating from the VA is the highest level of service-connected disability compensation awarded to veterans. It signifies that the veteran’s condition severely affects their ability to work or function in daily life. This rating may be assigned based on medical evaluation or through Total Disability based on Individual Unemployability (TDIU), which applies when a veteran can’t secure or maintain gainful employment due to their service-connected conditions.

Knowing the difference between a temporary and permanent 100% rating is essential. A permanent and total (P&T) designation means the veteran’s condition is unlikely to improve.

For VA benefits for surviving spouses to continue post a veteran’s death, their disability rating must be:

- Had a permanent and total disability rating (not subject to future examinations)

- Held the 100% disability rating for at least 10 continuous years before death

- Held the rating for 5 continuous years following discharge if the veteran died from a non-service-related cause, or

- Held the rating for at least 1 year prior to death, if the veteran was a former prisoner of war (POW)

Permanent and total disability status opens the door for several benefits for surviving spouses.

Establishing a Service-Connected Death for VA Benefits

To receive VA survivor benefits, you need to demonstrate that your spouse’s death was linked to their military service or that they qualified under specific exceptions. This process involves providing thorough and accurate documentation to support the claim.

Evidence to Prove a Service-Connected Death:

- Veteran’s Death Certificate: Should mention a service-connected condition as the primary or contributing cause of death. It is also possible to link service-connected disabilities to the cause of death as materially contributing.

- Service Medical Records (SMRs): Provide evidence of in-service illness, injury, or exposure related to the cause of death.

- VA Disability Rating Letter: Confirms the veteran had a service-connected disability, ideally with a 100% Permanent and Total (P&T) designation.

- Nexus Letter: An independent medical opinion from a licensed physician linking the veteran’s cause of death to their service-connected condition, stating it is “at least as likely as not” related. While these letters are never required, they can be helpful in some cases.

- VA Form 21P-534EZ: This form is used to file a DIC claim, along with supporting documentation.

Proper documentation ensures faster claim approval and access to full VA survivor benefits.

Overview of Spousal Benefits Before and After Death

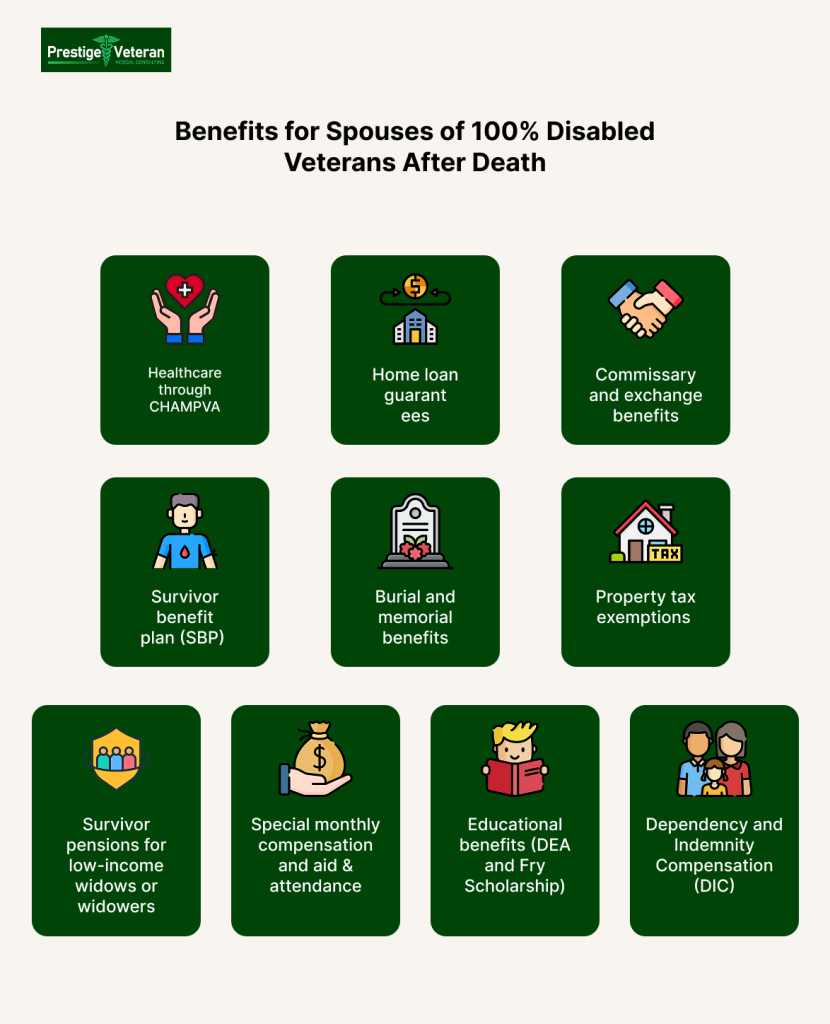

According to 38 CFR § 3.500(g), VA disability benefits end on the last day of the month before the veteran’s death. Spouses of 100% disabled veterans receive several significant benefits both during the veteran’s lifetime and after their death, such as:

- Healthcare through CHAMPVA

- Monthly compensation via DIC

- Educational benefits (DEA and Fry Scholarship)

- Home loan guarantees

- Burial and memorial benefits

- Property tax exemptions (state-specific)

- Survivor pensions for low-income widows or widowers

- Special monthly compensation and aid & attendance

- Survivor benefit plan (SBP)

- Commissary and exchange benefits

Understanding how each works and what continues after your spouse’s passing is key to maximizing support.

1. Dependency and Indemnity Compensation (DIC)

The Department of Veterans Affairs (VA) offers a vital, tax-free monthly payment to eligible surviving spouses of veterans who died in the line of duty or from a service-connected condition. Surviving spouses of veterans rated 100% permanently and totally disabled at the time of death, even if the cause of death wasn’t service-connected, may still qualify for DIC under specific conditions.

Current DIC Survivor Rates (Effective December 1, 2024)

As of 2025, the base monthly DIC rate is $1,653.07.

This amount can increase based on several factors, offering enhanced financial support to eligible spouses. DIC ensures that families of deceased veterans receive continued compensation in recognition of their spouse’s service and sacrifice.

Additional DIC Compensation (If Eligible):

- $351.02/month: If the veteran was rated 100% disabled for at least 8 years and the spouse was married to them for that duration.

- $409.53/month: If the surviving spouse requires Aid and Attendance (assistance with daily activities).

- $191.85/month: For a surviving spouse who is housebound due to a disability.

- $350.00/month (transitional): For surviving spouses with one or more dependent children under age 18, for the first two years after the veteran’s death.

- $409.53/month per child (DIC apportionment rate) – Paid for each eligible child under age 18.

Eligibility Criteria:

- Married to the veteran within 15 years of their discharge from the period of service in which the disability began, or for at least 1 year, or had a child together.

- Lived continuously with the veteran until their death (or any separation was not your fault).

- Remarriage allowed without loss of DIC only if:

- After age 57 (if remarried on or after December 16, 2003), or

- After age 55 (if remarried on or after January 5, 2021).

- Veteran died while on active duty, from a service-connected condition, or had a totally disabling service-connected rating at the time of death.

Visit the VA DIC eligibility page to review full eligibility requirements. If your claim for DIC was denied in the past, you can explore your VA decision-review options to appeal or submit new evidence.

Applications for military spouse benefits are submitted using VA Form 21P-534EZ with required documents like marriage and death certificates.

2. Survivors’ Pension

The VA Survivors Pension provides financial support to low-income, unremarried spouses of deceased wartime veterans with a 100% disability rating due to service-connected conditions. This needs-based, monthly, tax-free benefit helps cover essential living costs when income is limited.

Unlike DIC, the Survivor’s Pension is calculated based on income, meaning any earnings or Social Security benefits are subtracted from the maximum allowable benefit.

To qualify for military spouse benefits, the veteran must have:

- Served at least 90 days of active duty, including at least one day during an officially recognized wartime period, for example, Vietnam, Gulf War, World War II, and Korea (longer service required for post-1980 enlistment).

- Received a discharge other than dishonorable.

The surviving spouse must:

- Remain unmarried (except in cases of remarriage after age 57, which may still qualify).

- Have annual family income and net worth below limits set by Congress (adjusted annually).

Pension Amounts (as of 2025):

- Basic Survivors Pension: Up to $11,380 per year or $948 per month for qualifying surviving spouses without dependents.

- With Aid & Attendance: Up to $18,187 per year or $1,515 per month if the spouse needs daily care and assistance.

- With Housebound Status: Up to $13,907 per year or $1,159 per month.

Additional considerations:

- Medical expenses may reduce countable income, increasing benefit eligibility.

- You must apply using VA Form 21P-534EZ.

This pension serves as a critical safety net for surviving spouses facing financial hardship. Widows or widowers need to gather proof of wartime service and financial documents and apply through the VA or a certified Veterans Service Officer.

3. Healthcare Coverage: CHAMPVA

The Civilian Health and Medical Program of the Department of Veterans Affairs (CHAMPVA) offers comprehensive healthcare coverage to surviving spouses and dependents of veterans who were rated 100% permanently and totally disabled due to a service-connected condition at the time of death, or who died from a service-related disability.

CHAMPVA functions similarly to private health insurance, sharing the cost of medically necessary services with eligible beneficiaries. It covers a wide range of treatments, from routine checkups to hospital stays. Eligible dependents receive a CHAMPVA ID card.

To qualify, the surviving spouse must not be remarried (unless remarriage occurred after age 55) and must not be eligible for TRICARE. CHAMPVA can remain in effect as long as these conditions are met, even after the veteran’s death.

CHAMPVA Covers:

- Inpatient and outpatient services

- Prescription medications

- Mental health care

- Durable medical equipment (DME)

- Ambulance services

- Skilled nursing care and hospice

- Preventive care and family planning

Costs

CHAMPVA is free; however, there is a small annual deductible:

- $50 per individual or $100 per family

After the 70% reimbursement, beneficiaries have to pay 25% of the remaining allowable medical costs.

To apply, submit VA Form 10-10d and supporting documentation to the VA Health Administration Center.

For spouses over age 65, CHAMPVA works with Medicare Part B as secondary insurance. Benefits can resume if a remarriage ends in divorce or widowhood.

4. Educational Support: DEA and Fry Scholarship

Surviving spouses may be eligible for educational benefits under two major programs:

DEA (Chapter 35 – Survivors’ and Dependents’ Educational Assistance)

Spouses of veterans who were rated 100% permanently and totally disabled by the VA may be eligible for vital educational support through two primary VA programs: the Survivors’ and Dependents’ Educational Assistance (DEA) program and the Marine Gunnery Sergeant John David Fry Scholarship.

These initiatives aim to empower surviving spouses by providing financial aid for education and vocational training, helping them build toward self-sufficiency.

DEA Program (Chapter 35) offers monthly stipends to survivors for up to 36 to 45 months of education or training, which can be utilized for:

- College, graduate, or certificate programs

- Technical or vocational courses

- Apprenticeships and on-the-job training

- Licensing and certification exams

If a surviving spouse remarries before age 57, their eligibility ends on the remarriage date.

Monthly payments (as of 2025):

- $1,536 for full-time study

- $1,214 for ¾ time

- $890 for ½ time

- Reduced payments for part-time enrollment

Spouses of veterans have 10 years to use these benefits or 20 years if they died on active duty. However, if the veteran received a 100% disability rating more than three years post-discharge, the timeframe may extend to 20 years. And if eligibility starts on or after August 1, 2023, there is no time limit to use DEA benefits.

Fry Scholarship

This program extends Post-9/11 GI Bill benefits to surviving spouses or children of service members who died from a service-connected disability or sacrificed their lives in the line of duty on or after September 11, 2001.

Every spouse receives Fry Scholarship benefits, like:

- Full tuition and fees at public colleges, both private and foreign

- Monthly housing allowance

- $1,000 annual stipend for books and supplies

- Up to 36 months of benefits

Spouses must choose either DEA or Fry, unless eligible under special exceptions.

Fry benefits of veteran spouses who have remarried after January 2, 2025, may be restored. Use VA Form 22-5490 to apply for both the DEA (Chapter 35) and Fry Scholarship education benefits.

5. Home Loan Assistance for Surviving Spouses

Surviving spouses of veterans who were rated 100% permanently and totally disabled may be eligible for valuable VA home loan benefits, even after the veteran’s death. The VA Home Loan Guaranty Program offers financial relief and homeownership opportunities by backing loans through approved lenders, making mortgages more accessible and affordable.

Key benefits for surviving spouses include:

- No down payment required on VA-backed loans

- No private mortgage insurance (PMI), saving hundreds monthly

- Competitive interest rates compared to traditional loans

- Limited closing costs, helping reduce out-of-pocket expenses

- Financial hardship assistance to help prevent foreclosure for survivors

Eligibility

To qualify for these military spouse benefits,

- The veteran’s spouse must remain unmarried, unless remarriage occurred after age 57

- The cause of the veteran’s death must be a service-connected disability, or

- The veteran was assigned permanent and total disability (P&T) rating at the time of death, regardless of whether the death was service-related

Spouses may also use these benefits to purchase, build, repair, or refinance a home. A Certificate of Eligibility (COE) is required and can be obtained by submitting VA Form 26-1817.

This VA-backed support honors the veteran’s service by helping their loved ones achieve stable housing and long-term security.

6. Burial and Memorial Benefits

When a veteran with a 100% disability rating passes away, their surviving spouse may be eligible for extensive burial and memorial benefits through the Department of Veterans Affairs. These benefits honor the veteran’s service while offering meaningful financial and emotional support to their family.

VA-Provided Benefits

- Burial in a VA national cemetery

- A burial plot or columbarium niche

- Opening and closing of the grave

- Government-furnished headstone or marker

- Burial flag

- Presidential Memorial Certificate

- Perpetual care of the gravesite

If buried in a private cemetery, the VA may still provide a headstone, flag, and PMC, though burial costs are not covered.

Additionally, families of deceased veterans may qualify for a burial allowance of up to $2,000 if the veteran’s death was service-connected. For non-service-connected deaths on or after October 1, 2024, the VA allows $978. Spouses traveling to visit a grave overseas may receive no-fee passports under special provisions.

To receive burial and memorial benefits, spouses must apply through a Veteran Service Officer or the VA’s national cemetery scheduling office. Burial and memorial benefits by the VA ensure the sacrifices of both the veteran and their surviving spouse are remembered with dignity and honor.

VA Form 21P-530 is used to apply for the VA burial allowance.

7. State-Based Property Tax Exemptions

Many states offer property tax relief to the surviving spouses of 100% disabled veterans. While these military spouse benefits are not federally mandated, many states extend them to help survivors maintain stable housing.

Typically, these property tax exemptions apply to the primary residence of the surviving spouse. Eligibility for VA survivor benefits often depends on:

- The VA disability rating assigned to the veteran at the time of death

- Whether the death was service-connected

- The spouse remaining unmarried

- The residence being owned and occupied by the spouse

Benefits of Property Tax Relief May Include:

- Full property tax exemption in states like Florida, Texas, and Illinois

- Partial tax reductions or assessed value discounts in states such as California, New York, and Virginia

- Transferable property tax benefits if the spouse moves to a new primary residence

- No income cap in many states, though some require financial need documentation

View Property Tax Exemptions by State

Surviving spouses must apply through their local county assessor’s office, providing the veteran’s disability documentation and proof of residency. These exemptions can result in thousands of dollars in annual savings, offering long-term financial relief while honoring the veteran’s service.

8. Special Monthly Compensation and Aid & Attendance

Surviving spouses of veterans who had a 100% permanent and total VA disability rating may qualify for additional financial support through Special Monthly Compensation (SMC) and Aid & Attendance (A&A). These enhanced benefits are designed to assist spouses who face health challenges or need help with everyday activities following their veteran’s death.

Aid & Attendance is available to surviving spouses who:

- Require help with daily tasks such as bathing, dressing, or feeding

- Are bedridden or residing in a nursing care facility

- Have limited eyesight (corrected visual acuity of 5/200 or less)

If eligible, spouses can receive an additional monthly benefit on top of their Dependency and Indemnity Compensation (DIC). As of 2025, this A&A amount for a surviving spouse is $409.53 per month on top of their base DIC. That brings the total monthly benefit to $2,062.60, assuming the standard DIC rate of $1,653.07.

Special Monthly Compensation may also apply if the surviving spouse is housebound, providing an added $191.85 per month. These benefits do not require separate income qualifications but must be supported by medical evidence.

To apply, surviving spouses should submit medical documentation with their DIC claim or separately through a VA Form 21-2680.

These benefits offer essential support for daily living and ensure surviving spouses receive the care and dignity they deserve.

9. Survivor Benefit Plan (SBP)

The Survivor Benefit Plan (SBP) is a Department of Defense annuity program elected by military retirees that allows eligible spouses to receive up to 55% of the veteran’s retirement pay.

When a veteran with a 100% VA disability rating passes away, their surviving spouse may be eligible for continued financial support through the Survivor Benefit Plan (SBP). If the veteran opted into SBP and paid premiums during retirement, this monthly benefit continues after death.

However, when a spouse receives Dependency and Indemnity Compensation (DIC) from the VA, SBP payments are typically offset by the DIC amount. This means the spouse receives only the difference between the two benefits.

When DIC completely offsets SBP payments, the VA issues a refund of previously paid SBP premiums, offering a valuable financial reimbursement. These refunds are taxable income because the original premiums were deducted pre-tax.

Additional Considerations:

- SBP benefits are protected from inflation and include cost-of-living adjustments (COLA)

- Spouses of veterans who remarry after age 57 can retain both SBP and DIC

- Refunds are not issued for SBP elections made during special open enrollment periods

Veterans may also have Servicemembers’ Group Life Insurance (SGLI) or Veterans’ Group Life Insurance (VGLI), which may pay benefits directly to the spouse or estate.

10. Commissary and Exchange Privileges

After the death of a 100% disabled veteran due to a service-connected condition, their surviving spouse may be eligible for continued access to commissary and exchange benefits through the VA. These privileges allow the spouse to shop at military commissaries and exchanges, offering significant discounts on groceries, household items, and other goods.

Benefits Include:

- Eligible spouses can shop at military commissaries for discounted groceries and essential items.

- Privileges at military exchange stores (AAFES, NEX, MCX, CGX), where they can do tax-free shopping on a wide range of products.

- Use of online exchange shopping portals.

- Eligibility for morale, welfare, and recreation (MWR) facilities in some cases.

Access to these survivors’ benefits is typically granted through a VA-issued ID card or a Defense Enrollment Eligibility Reporting System (DEERS) record. Spouses can check their status and apply through their local VA office or military ID card facility.

In addition to VA benefits, various organizations offer emotional support, financial assistance, and resources to surviving spouses of disabled veterans.

How to Apply for VA Survivor Benefits

Applying for VA survivor benefits requires diligence, documentation, and time. Here’s a step-by-step guide to help you through the application process, which is available on VA.gov:

1. Notify the VA

Contact the VA at 1-800-827-1000 to immediately report the veteran’s death. This helps initiate the benefits process and prevents overpayments.

2. File an Intent to File

As a spouse, file an Intent to File (VA Form 21-0966) to lock in your effective date for VA benefits like DIC or Survivors Pension while you gather the required documents. You will have up to one year to complete your full application, and your VA compensation will be paid retroactively from the date the intent was filed, not the date your claim is finished.

This important step can result in thousands of dollars in back pay for surviving spouses and dependents.

3. Gather Necessary Documents

Start by collecting:

- Veteran’s DD214 (discharge papers)

- Death certificate

- Marriage certificate

- Children’s birth certificates (if applicable)

- Service treatment or VA medical records

- VA disability rating letter (showing 100% P&T status)

- Financial documents, e.g., proof of income/assets, net worth (for benefits like the Survivors Pension)

- Social Security numbers

- School or college enrollment verification

These documents prove your relationship with the deceased veteran, their active military service, and your eligibility for benefits.

4. Choose the Right Application Forms

Every military spouse benefit has a different application form, for example,

- For receiving DIC, Survivors Pension, or accrued benefits, submit VA Form 21P-534EZ.

- For education benefits (DEA or Fry Scholarship), use VA Form 22-5490.

- For CHAMPVA health benefits, complete VA Form 10-10d.

- For home loan eligibility, you need to file VA Form 26-1817 for a Certificate of Eligibility.

All forms are available on VA.gov or through your local VA office.

5. Submit Your Application

You can apply for VA spousal benefits:

- Online via VA.gov

- By Mail: Send to the Pension Management Center in your region

- In Person: At any regional VA office

- Seek Assistance: VA-accredited Veterans Service Organization (VSO) like DAV, VFW, and American Legion can guide you through the process for free.

5. Track Your Application

Track the status of your benefits application by signing in to your VA.gov account or contacting the VA directly. Processing time can take several months, varying based on complexity and the type of survivor benefit.

PACT Act and VA Benefits for Surviving Spouses

The 2022 PACT Act (Promise to Address Comprehensive Toxics Act) expands VA benefits for surviving spouses, dependent children, or parents of Veterans exposed to toxic substances like burn pits and Agent Orange.

Meaning, if your spouse was a 100% disabled Veteran and passed away from a PACT Act-related condition, you may now qualify for VA Dependency and Indemnity Compensation (DIC). For example, chronic respiratory illnesses, reproductive or head cancers, and hypertension, among others.

Even if your claim was denied before, the VA encourages all survivors to reapply, and benefits may be retroactive to your original application date. Surviving spouses, in this case, may also receive a one-time accrued benefits payment and a Survivors’ Pension if the Veteran had wartime service.

Additional spousal benefits include VA burial allowance, educational assistance, home loans, and CHAMPVA healthcare.

Apply online using VA Form 21P-534EZ and consult a VSO to explore your eligibility.

Calculating Monthly Payments for a Surviving Spouse

A surviving spouse is awarded DIC compensation after the death of a veteran who was rated 100% permanently and totally disabled (P&T) for 10 years prior to a service-connected death. The spouse was married to the veteran for more than eight years, is housebound, and is caring for one dependent child under the age of 18.

The following table outlines the monthly DIC benefits the spouse is eligible to receive, based on 2025 VA disability pay rates:

Monthly DIC Benefit Calculation

| VA Benefit | Eligibility | Amount |

| Base DIC Rate | All eligible surviving spouses | $1,653.07 |

| Additional for 100% Disabled (8+ years) & Married (8+ years) | Yes | +$351.02 |

| Housebound Allowance | Yes | +$191.85 |

| Dependent Child Allowance (per child under 18) | 1 child | +$409.53 |

| Transitional Child Benefit (first 2 years only) | Yes | +$350.00 |

Total Estimated Monthly DIC Payment: $2,955.47

Use VA.gov or a VSO for personalized calculations.

Need Help? Speak with a County Veterans Service Officer (VSO)

County Veterans Service Officers (VSOs) are trained advocates who provide free, expert help to surviving spouses just like you.

Talk to a VSO Now: Call 1-800-827-1000 to connect with a local Veterans Affairs representative who can direct you to your nearest County VSO.

Prefer to Chat? Use the VA’s live chat or visit your County VSO office directly for personal assistance.

Find your County VSO here: County VSO Directory (VA.gov)

Conclusion

Losing a spouse who was a totally disabled veteran is a deeply personal and life-changing event. While nothing can replace your loved one, understanding what steps to take to secure VA survivor benefits after their passing is crucial. This guide walks surviving spouses through essential information about who qualifies, how to prove service connection, and how to navigate the VA’s application process.

Knowing your rights, gathering the correct documents, and submitting the proper forms can help ensure timely support. If you are a surviving spouse of a 100% disabled veteran, staying informed is the first step toward protecting your future and preserving your loved one’s service legacy.

FAQs

Will my wife continue to receive my VA disability benefits when I die?

Your VA disability payments will discontinue after your death, but your wife may be eligible for tax-free survivors’ benefits like Dependency and Indemnity Compensation (DIC).

What benefits do spouses of deceased veterans get?

Surviving spouses may receive Dependency and Indemnity Compensation (DIC), Survivors Pension, CHAMPVA health coverage, education benefits, home loan assistance, burial benefits, and more, depending on eligibility.

How much does the widow of a 100% disabled veteran receive?

As of 2025, a widow of a disabled veteran may receive a base DIC rate of $1,653.07 monthly, with possible increases for factors like long marriages, Aid and Attendance, dependent children, and housebound status.

How much is the VA widow’s pension?

The 2025 VA Survivors Pension for widows with no dependents is $11,380 per year or $948 per month. This pension amount may change depending on income level, Aid & Attendance eligibility, and housebound status.

What are the maximum benefits for disabled veterans?

The highest monthly compensation for a 100% disabled veteran with a spouse and dependents in 2025 can exceed $4,000, depending on specific circumstances like Special Monthly Compensation (SMC).

What is the VA permanent and total disability?

A permanent and total (P&T) VA disability rating means the veteran’s service-connected condition is severe, lifelong, and qualifies their family members for extended survivor benefits if death occurs.

How do I reapply if my VA survivor benefits were denied?

If your VA survivor benefits were denied, submit VA Form 21P-534EZ within 1 year to retain benefits retroactively and consider getting assistance from a Veterans Service Organization (VSO).

Will I lose DIC benefits if I remarry?

If you remarry before age 57, you typically lose DIC, but remarriage after 57 allows you to retain it.

How Long Do Surviving Spouse Benefits Last?

VA survivor benefits continue for life unless the spouse remarries before age 57 or becomes ineligible under program rules.

Can I Become Eligible to Get Both DIC Benefits and a VA Pension?

No, you cannot receive both DIC and a Survivors’ Pension at the same time; you receive the greater of the two.

Also read: 2025 VA Disability Pay Chart: COLA Increase, Payment Schedule, Impact on Veterans

At Prestige Veteran Medical Consulting, a veteran-owned company, we specialize in Independent Medical Opinions (IMOs) known as Nexus letters.

Our purpose is to empower YOU, the veteran, to take charge of your medical evidence and provide you with valuable educational tools and research to guide you on your journey.

Understanding the unique challenges veterans face, our commitment lies in delivering exceptional service and support.

Leveraging an extensive network of licensed independent medical professionals, all well-versed in the medical professional aspects of the VA claims process, we review the necessary medical evidence to incorporate in our reports related to your VA Disability Claim.

Prestige Veteran Medical Consulting is not a law firm, accredited claims agent, or affiliated with the Veterans Administration or Veterans Services Organizations. However, we are happy to discuss your case with your accredited VA legal professional.

2 Responses

I may need for your help after I hear from the VA about my DIC claim I filed about 2 months ago…

Happy to try to assist. It looks like we sent you a few emails over the past week. Please respond to those when you have a chance