The Department of Veterans Affairs uses a system of protections known as the 5, 10, and 20-Year Rules to help prevent unfair rating reductions and preserve veterans’ benefits with service-connected conditions. Whether you are newly rated or nearing one of these milestones, knowing how these rules work can empower you to protect your monthly compensation.

From stabilizing your rating to protecting your service connection, we will dissect each rule, explain how they apply in real-life veteran cases, and note proactive steps to maintain your VA benefits for the long haul.

Table of Contents

Understanding VA Disability Ratings

A VA disability rating measures how much a service-connected condition affects a veteran’s health and daily life. These ratings range from 0% to 100% in 10% increments, directly influencing monthly compensation and access to other VA benefits. The Department of Veterans Affairs uses the Schedule for Rating Disabilities, applying specific diagnostic codes based on how a condition impacts work and social functioning.

To receive a disability rating, veterans must submit three key evidence:

- A current medical diagnosis

- Documentation of an in-service injury or event

- A medical nexus letter linking the condition to military service

Additional documentation, like ongoing medical records, Compensation & Pension (C&P) exam results, Disability Benefits Questionnaires (DBQs), and lay testimony, can further support your VA claim.

Understanding the VA rating process empowers you to advocate for fair benefits and protect your claim from unfair reductions.

What Are the VA 5, 10, and 20-Year Rules and Why Do They Matter?

When it comes to VA disability benefits, the 5, 10, and 20-year rules are key protections that can safeguard your rating over time. The Veterans Affairs follows these rules to provide stability for veterans, recognizing that certain conditions may be permanent or unlikely to improve. They prevent the VA from arbitrarily reducing ratings, ensuring that veterans aren’t left vulnerable after years of receiving benefits. Understanding these rules enables veterans to protect the compensation they have earned through their service.

The 5-Year Rule: Stabilized Ratings for the Veterans

The VA’s 5-Year Rule protects disability ratings that have remained unchanged for five or more consecutive years. This protection means the VA cannot reduce your rating unless there is clear and consistent medical evidence showing sustained and material improvement under normal life conditions.

Key points about the 5-Year Rule:

- A disability rating becomes “stabilized” after five consecutive years without change.

- One-time or short-term improvements don’t automatically result in decreased compensation.

- Temporary relief from symptoms due to medication, rest, or therapy does not justify a rating reduction.

- Within the first five years of a rating, the VA may schedule routine exams if improvement is likely.

- Once the five-year mark is reached, the burden shifts to the VA to prove sustained improvement with a much higher standard to justify any rating reduction.

Real-Life Veteran Case

Derrick Shaw was rated at 50% for chronic lumbar strain in 2018. By 2023, his condition had been consistently rated without change. After a short round of physical therapy, a VA Compensation and Pension (C&P) exam showed some temporary improvement. The VA attempted to reduce his rating, claiming his condition had improved. However, with support from a Veteran Service Organization (VSO), he challenged the decision under the 5-Year Rule. He argued the improvement was not sustained under ordinary conditions, as he still experienced daily pain, limited mobility, and difficulty maintaining full-time work. The VA lacked sufficient evidence, and his rating was reinstated.

For veterans, the 5-Year Rule gives peace of mind by stabilizing their current ratings and compensation.

The 10-Year Rule: Protecting Service Connection from Termination

According to the VA’s 10-Year Rule, once a condition has been service-connected for 10 consecutive years, the VA cannot legally sever that connection, except in cases of proven fraud. This rule safeguards a veteran’s right to receive VA compensation for a service-connected disability, regardless of rating changes or administrative errors. VA may still reduce a rating in some circumstances if there has been material improvement based upon an actual change in the disability since the last rating.

Key points about the 10-Year Rule:

- After 10 years of continuous service connection, the VA can’t sever it unless there’s proof of fraud.

- The rule protects the service connection, not the percentage rating; reductions are still possible if the VA shows sustained improvement.

- The 10-Year Rule is significant when medical records are incomplete, missing, or disputed.

- Once this milestone is reached, the burden of proof shifts in favor of the veteran.

Veterans should still maintain updated medical evidence and comply with VA requests to protect their service connection.

Real-Life Veteran Case

Maria, an Army veteran, was granted service connection for PTSD in 2014 after experiencing trauma during deployment. By 2024, she had maintained treatment, but due to a clerical error in a 2023 VA system update, her PTSD was flagged for termination. Complicating matters, Maria had moved states, and her new provider hadn’t yet transferred records. The VA issued a proposal to sever her service connection. With help from her new psychiatrist and a veterans’ legal clinic, Maria appealed. Citing the 10-Year Rule, she proved continuous service connection with no fraud. Her benefits were reinstated, though her rating was reevaluated.

Hence, the 10-Year Rule acknowledges a decade of service connection entitlement, protecting veterans’ disability benefits they have long relied upon.

The 20-Year Rule: Continuous Rating Protection

Among the VA’s 5, 10, and 20-year rules, the 20-Year rule provides maximum rating protection for veterans receiving VA disability benefits. Once a rating has been in effect for 20 or more continuous years, the VA cannot reduce it unless the original rating was based on fraud. This rule offers veterans suffering from service-connected conditions lasting security and peace of mind.

Key points of the 20-Year Rule:

- Strongest protection available for VA disability ratings.

- Applies to continuous VA ratings, meaning there must be no interruption due to re-evaluation or reduction during the 20-year threshold.

- Even if the veteran’s condition improves, the rating remains intact unless clear evidence shows the original rating was fraudulent.

- Provides long-term stability for veterans with chronic or fluctuating VA disabilities as they age.

Retroactive Benefits

If the VA retroactively increases a disability rating, whether due to a recent decision or updated standards, and the condition dates back 20 years or more, the higher rating is retroactive and automatically protected under the 20-year rule.

Real-Life Veteran Example

A retired Army sergeant was rated 60% disabled for a traumatic brain injury and chronic migraines sustained during combat in Iraq. For over 20 years, his condition remained stable under VA review, though recent treatments have significantly reduced the frequency of his migraines. Despite the improvement, the VA could not reduce his rating due to the 20-Year Rule. His rating had been continuous with no lapses or reductions, and there was no evidence of fraud in the original decision. This protection gave the veteran financial stability in retirement regardless of his condition’s improvement.

Veterans approaching this 20-year milestone should verify that their rating history reflects uninterrupted service connection.

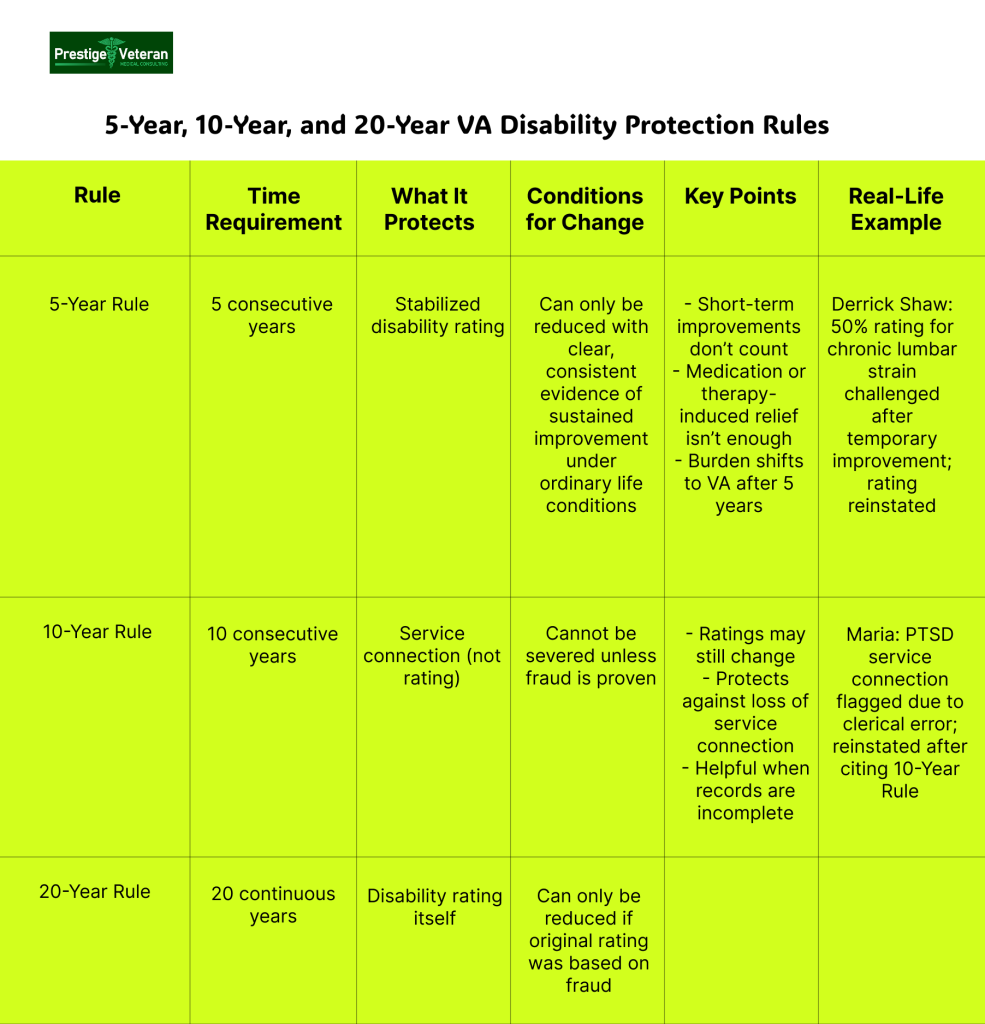

5-Year, 10-Year, and 20-Year VA Disability Protection Rules

Permanent and Total Disability: Lifelong Protection with Full Compensation

Permanent and Total (P&T) status provides a veteran with complete VA disability benefits protection. This protection is given when a service-connected condition is both totally disabling and unexpected to improve over time. Permanent and Total Disability provides lifelong compensation, exempts veterans from routine reevaluations, and offers added benefits for dependents.

A condition is considered “total” with a 100% rating or if the veteran qualifies for Total Disability based on Individual Unemployability (TDIU), meaning they cannot maintain substantially gainful employment due to service-connected disabilities. It’s “permanent” when medical evidence shows the condition won’t improve throughout the veteran’s lifetime.

Real-Life Veteran Example

A veteran with terminal cancer, severe PTSD, or amputation of both legs may be assigned P&T status due to the irreversible and debilitating nature of the condition. Once P&T is granted, the VA will stop scheduling future exams, offering the veteran peace of mind that their benefits are secure.

Veterans with P&T disability may also qualify for benefits like:

- Dependents Educational Assistance (DEA) granted for veterans’ children and spouses

- Healthcare benefits for dependents through CHAMPVA

- Commissary and exchange privileges

- State tax exemptions, fee waivers, and housing benefits (varies by state)

- Expedited Social Security Disability processing

P&T status is not automatically given with a 100% rating, veterans must be awarded it directly or request it with supporting documentation. This may include medical statements from VA or private doctors confirming the condition is not expected to improve over time.

Securing Permanent and Total Disability status ensures your financial future, extends support to your family, and removes the stress of possible rating reductions. If you believe your condition qualifies, speak with your doctor and a Veteran Service Officer to apply.

The 55-Year Rule: Reevaluation Exemption Based on Age

Apart from the VA’s 5, 10, and 20-year rules, there is one more provision to protect a veteran’s benefits. VA’s 55-Year Rule is an internal policy observed by the Department of Veterans Affairs that helps protect older veterans from unnecessary and tiring reexaminations. Once a veteran reaches the age of 55, the VA will no longer schedule routine reexaminations of their service-connected disabilities unless there is clear evidence of fraud, filing error, or specific conditions like cancer.

This 55-Year Rule reflects the understanding that aging reduces the likelihood of medical improvement, and repeated exams can be stressful for those with chronic or degenerative conditions.

VA’s Definition of Age-Based Exemption

The VA typically conducts Compensation & Pension (C&P) exams every two to five years to review and possibly adjust a veteran’s disability rating. However, according to VA’s Compensation and Pension Manual M21-1, Part IV, Subpart ii, Chapter 1, Section A, veterans who are 55 or older at the time of a scheduled reexamination are generally exempt unless a specific regulation applies. This rule reduces routine exams but doesn’t guarantee absolute rating protection.

Ratings can still be reevaluated under the following exceptions:

- The veteran has a cancer diagnosis that goes into remission; the VA may conduct periodic exams even after age 55.

- New medical evidence suggests that the disability has materially improved or if the original rating was clearly flawed.

- Filing for a new claim (e.g., for special monthly compensation or secondary conditions).

- Undergoes surgery related to a service-connected condition.

- Diagnosed with service-connected conditions such as an infectious disease expected to improve with time.

Real-Life Veteran Example

For instance, consider Roger, a veteran who turned 55 last year and has a 60% rating for spinal issues. Unless the VA has specific evidence indicating his condition has drastically improved, they will not schedule further exams. His VA rating is essentially stabilized based on age and the unlikelihood of recovery.

To take full advantage of this policy, attend all scheduled exams until age 55 and keep detailed medical records. After 55, the risk of rating reductions decreases, giving you long-term financial security.

When and Why the VA Conducts Reevaluations?

The VA conducts reevaluations to assess whether a veteran’s service-connected disability has improved, worsened, or remained stable. Reevaluations can often occur 6 months after being discharged from military service and 2 to 5 years after the initial rating is granted, especially if the VA believes the condition may improve over time.

Often scheduled as Routine Future Examinations (RFEs), their goal is to ensure disability compensation accurately reflects the severity of a veteran’s current condition. If a veteran’s condition shows substantial improvement, the VA may lower their current disability rating, thereby reducing their monthly compensation.

Missing a re-examination can result in reduced or terminated benefits, so it’s essential to attend and bring relevant medical records. Veterans should clearly explain ongoing symptoms during the exam.

In some cases, veterans may request a reevaluation if their condition worsens and they wish to seek an increased rating. Reevaluations help the VA ensure that only fair, appropriate compensation is granted to the veterans.

What to Do If the VA Proposes a Disability Rating Reduction?

Receiving a letter from the VA proposing to reduce your disability rating can be alarming, but it’s not a final decision. When the VA proposes a reduction, it must send you a written notice outlining the reasons for the proposed change.

This letter starts a critical countdown:

- You have 60 days to provide supporting evidence to challenge the proposed change.

- You have 30 days to request a personal hearing to present your case before any final decision is made.

During this time, Veterans and their accredited legal professionals respond quickly by taking the most effective actions:

- Submit updated medical records showing that your VA disability has not improved.

- Provide a new Disability Benefits Questionnaire (DBQ) from a treating provider if applicable.

- Collect lay statements from family, friends, or employers who can describe how your disability affects your daily life and ability to work.

- Include a personal log of flare-ups, medications, hospital visits, and missed workdays.

- Write a personal statement explaining why the rating should not be reduced.

If you miss the deadlines, the VA may finalize the rating change. In that case, you still have three appeal options according to VA’s appeals modernization act: you can file a Supplemental Claim, request a Higher-Level Review, or appeal directly to the Board of Veterans’ Appeals.

A veterans service organization (VSO) or a VA-accredited attorney can guide you through this process, helping you keep the benefits you have earned.

Conclusion

VA disability protections are powerful tools, but only if you know how to use them. Understanding the 5-, 10-, 20-, and 55-Year Rules, as well as other policies, can secure your benefits from unnecessary reductions and reviews.

Protecting your VA disability rating is a long-term effort that goes beyond the claims process. It requires consistency, documentation, and awareness of how the VA evaluates conditions. The more proactive you are in managing your benefits and healthcare, the better your chances of keeping your rating intact over time.

Your benefits are earned through sacrifice. Stay informed, be proactive, and seek help from accredited legal professionals if needed.

FAQs

What is the 20-year rule for VA compensation?

The 20-year rule for VA compensation protects veterans from rating reductions if a disability rating has been in place for 20 or more years, except for claims based on fraud.

What is the 5, 10, and 20-year rule?

The VA’s 5, 10, and 20-year rules are protections that prevent arbitrary disability rating reductions and service connection terminations after specific periods.

Can VA reduce a rating after 20 years?

No, the VA cannot reduce a rating after 20 continuous years unless there is clear evidence the original rating was based on fraud.

Does VA disability become permanent after 5 years?

No, a VA disability rating does not automatically become permanent after 5 years, but it becomes stabilized and harder to reduce without sustained evidence of improvement.

How does the VA’s 5-year rule apply to PTSD disability ratings?

Under the 5-year rule, if a veteran’s PTSD rating has remained unchanged for five years, the VA must provide clear evidence of material improvement before reducing it.

Also read: When Do You Need a Nexus Letter for a VA Claim?

At Prestige Veteran Medical Consulting, a veteran-owned company, we specialize in Independent Medical Opinions (IMOs) known as Nexus letters.

Our purpose is to empower YOU, the veteran, to take charge of your medical evidence and provide you with valuable educational tools and research to guide you on your journey.

Understanding the unique challenges veterans face, our commitment lies in delivering exceptional service and support.

Leveraging an extensive network of licensed independent medical professionals, all well-versed in the medical professional aspects of the VA claims process, we review the necessary medical evidence to incorporate in our reports related to your VA Disability Claim.

Prestige Veteran Medical Consulting is not a law firm, accredited claims agent, or affiliated with the Veterans Administration or Veterans Services Organizations. However, we are happy to discuss your case with your accredited VA legal professional.