Total Disability based on Individual Unemployability (TDIU) helps veterans receive full disability compensation when service-connected disabilities make steady employment impossible. Many veterans find that their disability ratings do not reflect the true impact of their conditions on daily functioning and earning capacity. Which is why TDIU enables the VA to focus on how disabilities affect a veteran’s ability to work, not just the percentage assigned.

This guide breaks down the current payment amounts, qualification rules, and how dependents can affect monthly benefits. Whether applying or already receiving TDIU benefits, knowing what VA considers when evaluating unemployability helps you file your claim with confidence.

Table of Contents

What is TDIU for Veterans?

Total Disability based on Individual Unemployability (TDIU) is a VA benefit for veterans whose service-connected conditions prevent them from maintaining “substantially gainful employment”. Even when a veteran’s disability ratings do not add up to 100 percent, TDIU allows the VA to pay compensation at the same rate as a fully disabled veteran.

The Department of Veterans Affairs grants veterans two main types of TDIU: schedular and extraschedular.

TDIU vs. 100 Percent Rating

- 100% Schedular Rating: Awarded strictly by the VA’s rating schedule and based on the severity of your condition.

- TDIU (Individual Unemployability): Focuses on how your disabilities affect your ability to work. You are paid at the same 100% level because you cannot maintain employment, even if your combined rating is 60%, 70%, or 80%.

In both cases, the VA TDIU pay rate equals 100%, but the basis for the award is different. For example, a veteran with a significant heart condition, chronic pain, or serious mental health symptoms may be medically rated below a 100 percent disability rate but still be unable to meet the physical or cognitive demands of a job.

In these cases, TDIU benefits ensure that compensation reflects the real-world impact of their service-connected disability, not just rating percentages.

What is the monthly TDIU payment in 2026?

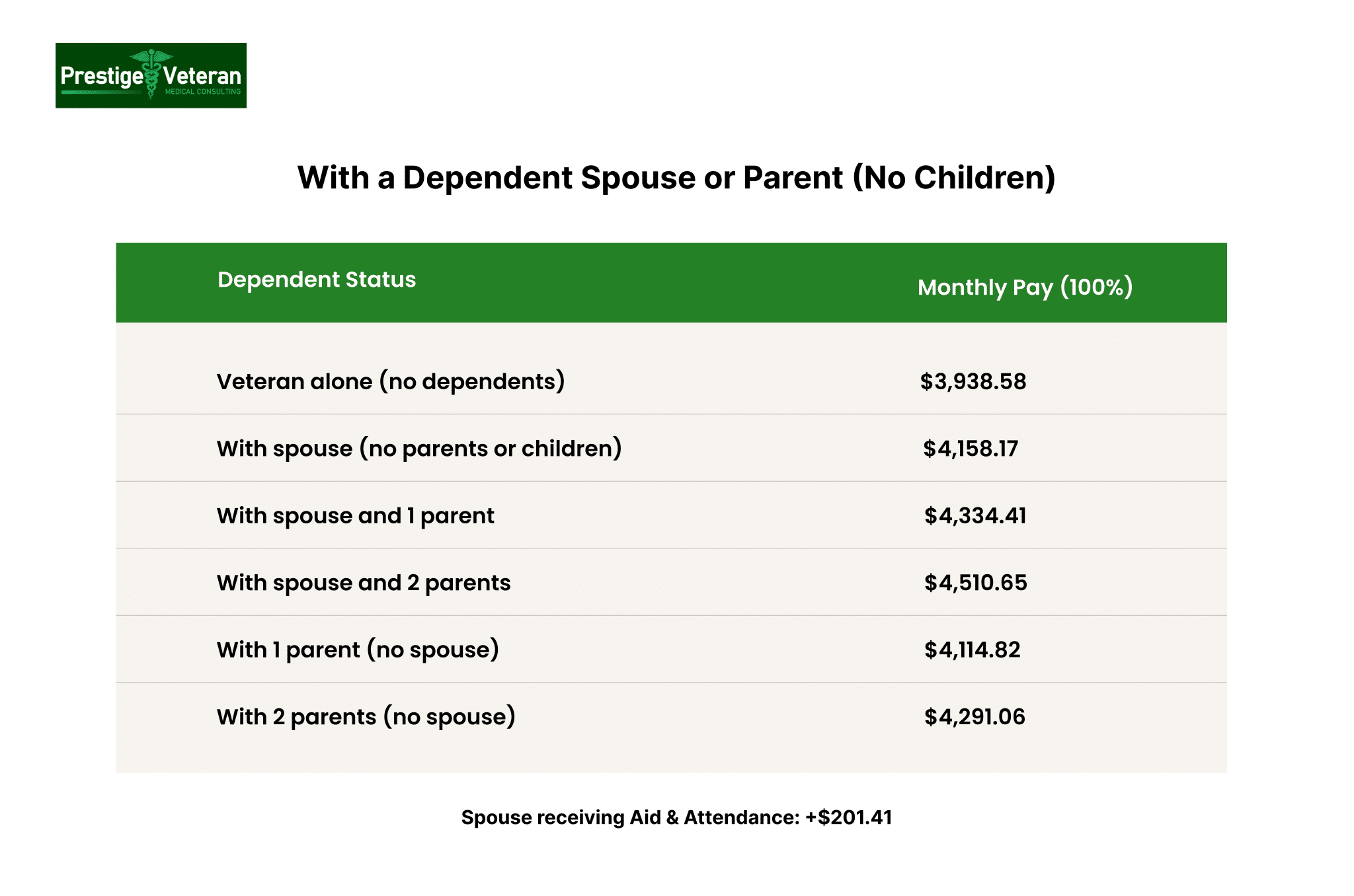

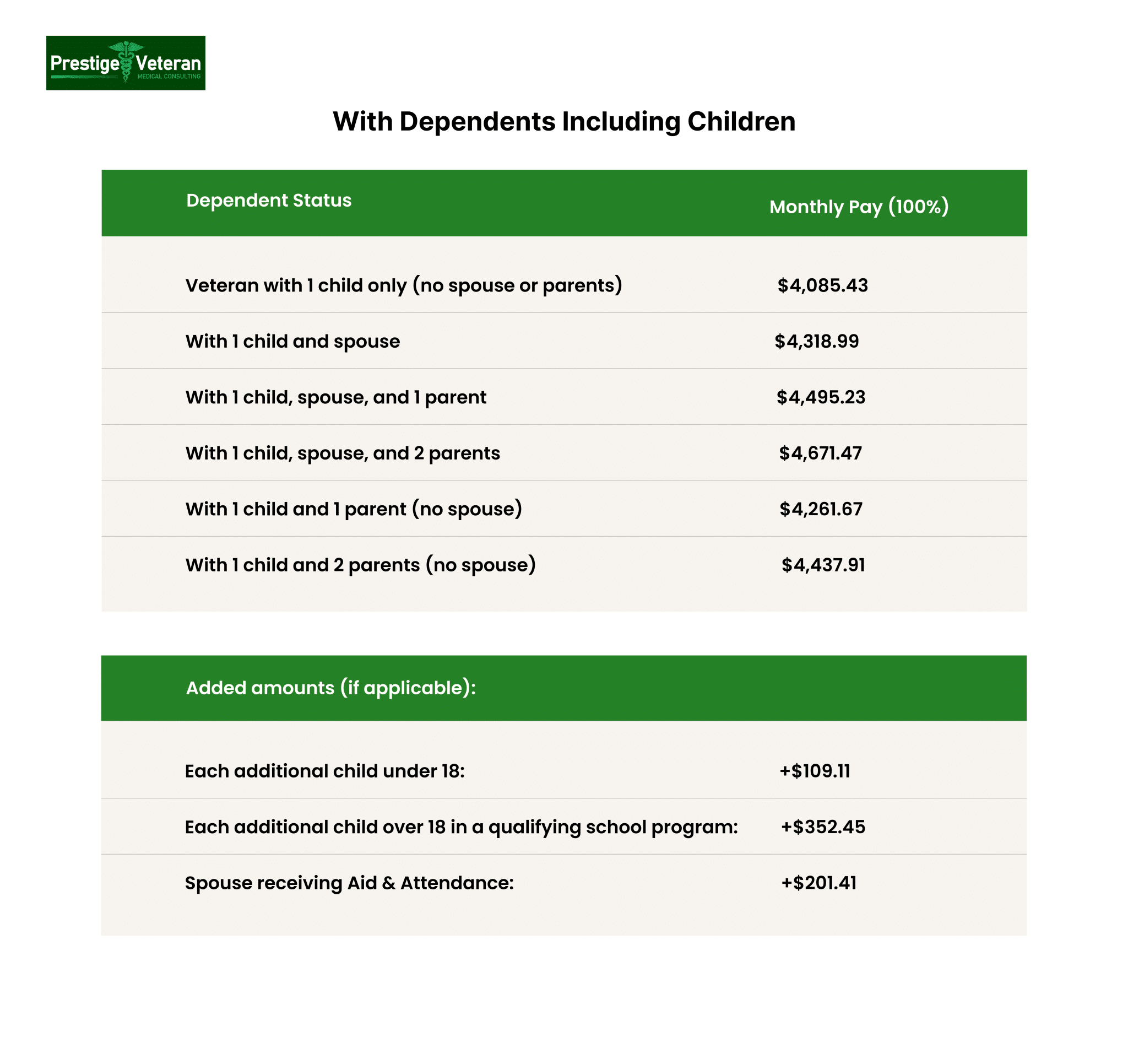

TDIU pays the same monthly amount as a 100% VA disability rating. In 2026, a 100% TDIU pays $3,938.58 per month for a single veteran without dependents. This amount may vary based on factors such as marital status, number of dependents, and any cost-of-living adjustments.

We’ll explore the full compensation breakdown later in this blog.

Who Qualifies for TDIU Benefits?

Schedular TDIU

To meet the schedular TDIU requirements under 38 C.F.R. § 4.16(a), you must have service-connected disabilities that meet one of the following thresholds:

- One disability rated at 60% or more, or

- Multiple disabilities with one rated at 40% or more and a combined rating of 70% or more.

Extraschedular TDIU

If you do not meet these requirements, you may still qualify under 38 C.F.R. § 4.16(b) for extraschedular TDIU. This applies when your disability picture is exceptional, such as frequent hospitalizations or unique limitations and still prevents substantially gainful employment despite lower ratings.

Unemployability Criteria: What “Substantially Gainful” Means

Individual Unemployability is based on your ability to work. Under 38 C.F.R. § 4.16(a), the VA defines substantially gainful employment as work that provides income above the federal poverty level. Work that does not meet this standard may still be allowed:

- Marginal employment: Jobs or earnings below the poverty threshold.

- Protected work environment: A position where an employer makes special accommodations (extra breaks, reduced duties, flexible attendance) that would not exist in a competitive workplace.

As long as your earnings fall within VA TDIU income limits and your service-connected conditions are the reason you cannot maintain regular employment, you may still qualify.

For 2025, the federal poverty threshold was $15,650 per year ($1,304 per month) for a single veteran. The 2026 figure is expected to be slightly higher once the Census Bureau releases the official figures.

Evidence that Strengthens a TDIU Claim

To decide if you qualify for TDIU, the VA reviews both medical and vocational evidence, including:

- Medical records and doctors’ opinions

- Employment history

- Vocational expert opinions, if available

- Compensation and Pension (C&P) exam reports

- Lay statements from you, family, or former employers

A veteran with a 70% combined rating for PTSD and a back injury who can no longer maintain full-time work and only earns below the poverty level may qualify for TDIU. Another veteran with the same ratings who holds a stable, well-paid job without special accommodations would likely not qualify.

2026 TDIU VA Compensation Payment Rates

How TDIU Pay Is Calculated

Total Disability Based on Individual Unemployability (TDIU) does not change your existing disability percentages. Instead, it compensates you at the 100% disability rate even if your combined schedular rating is lower. In other words, while your official rating remains the same, your monthly payment reflects the maximum benefit level.

Your actual payment for Individual Unemployability can be based on:

- Dependents: Spouse, children, and dependent parents increase your monthly benefit.

- Annual COLA: Each December, VA applies a federal Cost-of-Living Adjustment (COLA) to protect purchasing power against inflation. The 2026 rates are adjusted to reflect this annual increase.

- Permanent Status: If your award is deemed permanent and total, often referred to as 100% TDIU permanent and total benefits, you may qualify for additional family benefits such as education and health care programs.

2026 Monthly TDIU (100% Rate) Pay Amounts

The amounts reflect TDIU compensation at the 100% disability rate, effective December 1, 2025, following the annual Cost-of-Living Adjustment (COLA), as published by the U.S. Department of Veterans Affairs (VA.gov).

Check the official VA disability compensation rates to verify the latest payment amounts.

Getting Paid for the Time You Were Unemployable

When your VA TDIU claim is approved, you may receive back pay (also called retroactive pay) for the time you were unable to work due to your service-connected conditions. Retroactive payment covers the period from your effective date to the date your claim is granted.

Usually, the effective date is when you filed your TDIU application (VA Form 21-8940). However, if medical or vocational evidence shows you were unemployable earlier, VA can assign an earlier date, resulting in larger retroactive compensation.

Example: If your claim is approved in 2026 but your effective date is set in 2024, you will receive two years of back pay at the 100% TDIU rate (plus dependency additions).

Understanding how TDIU is paid and how effective dates work helps veterans maximize the VA benefits they have earned through service.

Is TDIU Considered as “Permanent and Total”?

TDIU is not considered permanent by default, but it can become Permanent and Total (P&T) if the VA determines your service-connected conditions are unlikely to improve. When the VA grants you Permanent and Total (P&T) status, it confirms that no future medical exams are required and that you’ll be compensated at the 100% disability rate. This status is often indicated in your decision letter with phrases such as “no future examinations scheduled” or by granting family benefits like Chapter 35 education or CHAMPVA.

If TDIU is not labeled permanent, the VA can review your case (especially within the first 5 years) and reduce benefits if your condition improves or if you return to earning gainful work. That said, long-term protection exists, as veterans who have held TDIU for 20 continuous years are generally shielded from reduction unless fraud is involved.

Example: A veteran with severe traumatic brain injury (TBI) may initially receive TDIU and later be granted permanent status once medical evidence shows no expected improvement.

TDIU Benefits for Spouse and Dependents

When a veteran is granted Total Disability based on Individual Unemployability, their spouse, children, and in some cases, survivors may qualify for valuable VA benefits. Families often gain access to programs normally reserved for totally disabled veterans, especially when the award is Permanent and Total (P&T).

Additional Monthly Compensation for Dependents

One of the main benefits of TDIU is increased monthly compensation when dependents are added to the veteran’s award. The VA provides higher payments for:

- A spouse

- Dependent children (including minors, students in approved education programs, or children with disabilities)

- Dependent parents who rely financially on the veteran

Below are the other important VA benefits for dependents of Permanent and total TDIU veterans.

1. Dependents’ Educational Assistance (Chapter 35)

Provides up to 45 months of education funding for college, technical training, certifications, apprenticeships, and approved on-the-job training programs.

2. CHAMPVA Health Care

The Civilian Health and Medical Program of the Department of Veterans Affairs offers low-cost medical insurance for covering doctor visits, prescriptions, hospital care, mental health treatment, and preventive services.

Those enrolled in CHAMPVA can also access discounted private dental insurance through VA Dental Insurance Program (VADIP).

3. VA Home Loan Guaranty for Surviving Spouse

Eligible surviving spouses may qualify for VA-backed home loans, refinancing options, and foreclosure assistance to secure stable housing.

4. Dependency and Indemnity Compensation (DIC)

Provides monthly tax-free payments to surviving spouses, children, or parents of veterans who died from service-connected conditions or held TDIU status for 10 years before death.

5. Burial and Memorial Benefits

Covers burial in a VA national cemetery, a government headstone or marker, burial flag, Presidential Memorial Certificate, and possible allowances to help offset funeral and interment expenses.

6. VA Life Insurance for Dependents

Offers affordable coverage for dependent spouses and children of veterans insured under Family Servicemembers’ Group Life Insurance (FSGLI), along with premium waivers and accelerated benefits.

7. Survivors’ Pension

Provides monthly income to low-income surviving spouses and unmarried dependent children of wartime veterans, helping cover basic living expenses such as housing, food, and medical care.

8. Vocational Rehabilitation & Employment (VR&E) Services

Grants eligible dependents access to career counseling, job-search assistance, resume development, and training resources.

Apart from these, dependents of unemployed veterans may also obtain property tax exemptions, commissary and exchange privileges, and other state-level benefits.

How to Apply for a VA TDIU Claim

To take advantage of VA benefits for dependents, veterans must ensure their TDIU eligibility, especially permanent and total disability, is documented well and that dependents are listed with the VA.

Here are considerations for Veterans considering submitting a well-supported TDIU application.

- Step 1: Confirm You’re Eligible

You must be unable to maintain substantially gainful employment because of service-connected disabilities. If you meet the VA’s TDIU criteria, you can move forward with your claim. - Step 2: Gather Required Forms

You may want to review these two forms:

-

- VA Form 21-8940 (Veteran’s Application for Increased Compensation Based on Unemployability) – your TDIU application (work history, education, when you became too disabled to work).

- VA Form 21-4192 (Employer Information) – completed by your most recent employer to verify income, time missed, and reason for leaving.

Step 3: Collect Strong Evidence

Gather documentation that demonstrates how your service-connected conditions interfere with your ability to work and maintain productivity. Include VA and private medical records, doctors’ statements, and employment records showing accommodations or job loss.

Step 4: Considerations for Filing Your Claim

Veterans may apply online via VA.gov, by mail or fax, in person at a VA office, or with help from a VSO, VA-accredited agent, or attorney.

Step 5: Attend the C&P Exam (If Scheduled)

VA may request a Compensation & Pension exam to evaluate how your disabilities affect your ability to work.

Step 6: Review the Decision Letter

VA will mail a decision explaining approval or denial, your effective date, and any back pay.

Step 7: Track Processing Time & Next Steps

TDIU claims can take several months to over a year. If denied, you may appeal through different options, including Higher-Level Review, a Supplemental Claim with new evidence, or the Board of Veterans’ Appeals.

Check the VA’s official TDIU eligibility and benefit guidelines to see whether you may qualify.

5 Common TDIU Claim Mistakes to Avoid

Applying for Total Disability based on Individual Unemployability (TDIU) can be life-changing, but small errors often lead to delays or denials. Avoid these common mistakes to strengthen your claim and protect your benefits.

1. Failing to Prove Unemployability Clearly

Many veterans meet the rating thresholds yet fail to explain how their service-connected conditions are a barrier to their employment. The VA weighs medical records, work history, education, and functional limits. Be specific: describe tasks you can’t perform, attendance issues, hospitalizations, or why accommodations didn’t work. A doctor’s medical opinion or vocational report can bridge the gap.

2. Missing Employer Forms (VA Form 21-4192)

The VA relies on your last employer’s statement to verify dates, income, missed work, and reasons for separation. A missing or incomplete VA Form 21-4192 can delay or weaken your TDIU claim. If an employer won’t respond, document your efforts and submit a written explanation.

3. Earning Above Marginal Income

If your income exceeds what the VA considers marginal employment, your TDIU claim may be denied. Submit tax returns, pay stubs, or Social Security earnings statements. If you work in a protected or sheltered environment, include evidence of special accommodations.

4. Submitting Incomplete Medical Evidence

Unemployability VA claims are denied when medical and vocational records don’t clearly show the severity of conditions or work impact. Ensure they specifically address functional impact, such as sitting, standing, concentration, and attendance.

5. Relying on Non-Service-Connected Conditions or Age

VA cannot consider age, retirement status, or non-service-connected disabilities when deciding TDIU. Claims that focus on these factors instead of service-related limitations often result in denial.

Avoiding these mistakes can significantly improve your chances of securing the TDIU benefits you deserve.

For personalized guidance, consider speaking with a VA-accredited representative, agent, or attorney who can review your situation and help you navigate the claims process.

Case Study: Extraschedular TDIU for a Below-Threshold Rating

Maria L., a 52-year-old Navy veteran, served 15 years on active duty from 1991 to 2006 as a hospital corpsman. She was medically discharged after developing service-connected fibromyalgia (40%), major depressive disorder (30%), and irritable bowel syndrome (10%), for a combined rating of 60%. Although she did not meet schedular TDIU criteria, her conditions created unpredictable pain, fatigue, cognitive “brain fog,” and frequent restroom needs.

Post-Service Employment and Functional Limitations

After separation, Maria worked as a medical receptionist at a private clinic. Despite a reduced schedule, she missed 6 to 8 days per month due to flare-ups and depressive episodes. Her employer allowed extended breaks, flexible hours, and limited remote work, but repeated patient scheduling errors and attendance issues by Maria led to her termination in 2023. She later attempted self-employment doing medical billing from home, but earned under $700 per month and could not maintain consistent productivity.

The VA initially denied TDIU because she did not meet the percentage requirements. With assistance from a VA-accredited representative, Maria appealed for extraschedular consideration under 38 C.F.R. § 4.16(b).

- A vocational expert opined that her combined physical pain, impaired concentration, and unpredictable gastrointestinal symptoms prevented any substantially gainful employment in a competitive setting.

- Statements from her former employer documented extraordinary workplace accommodations.

- Social Security earnings statements showing consistently marginal income since leaving full-time work.

After reviewing all evidence, the Board of Veterans’ Appeals referred the case to the Director of Compensation Service, and in 2025, the VA granted Maria extraschedular TDIU with retroactive pay to her original filing date.

Conclusion

TDIU exists to bridge the gap between disability ratings and real-life employability, ensuring veterans are compensated when their service-connected conditions make steady work impossible. Navigating unemployability benefits is about documenting how your service-connected conditions affect your daily function and long-term financial stability.

If you believe your disabilities prevent substantially gainful work, gather strong medical and vocational evidence and apply for TDIU without delay. When in doubt, seek help from a VA-accredited representative and ensure your claim reflects the full impact of your service.

Frequently Asked Questions (FAQs)

Can self-employed veterans qualify for TDIU?

Yes. Self-employed veterans may qualify for TDIU if their business income falls below the federal poverty threshold or if their work is only possible in a protected environment.

Is there a DBQ for TDIU?

There is no specific Disability Benefits Questionnaire (DBQ) for TDIU itself. However, during TDIU C&P exams, VA examiners use condition-specific DBQs to assess how your service-connected disabilities affect your ability to work.

What is the success rate of TDIU appeals?

There is no single official rate, but many TDIU appeals are granted when strong medical and employment evidence is provided, especially at the Board of Veterans’ Appeals.

Can I qualify for VA unemployability over 65?

Yes, you can qualify for TDIU even if you’re above 65, because VA bases unemployability benefits solely on service-connected disabilities and their impact on your ability to work.

How long will my TDIU benefits last?

TDIU continues as long as you remain unemployable due to service-connected conditions, and it can be permanent if your disabilities are deemed unlikely to improve.

Also Read: Who Qualifies as a VA Dependent? Here’s How to Apply for Benefits

At Prestige Veteran Medical Consulting, a veteran-owned company, we specialize in Independent Medical Opinions (IMOs) known as Nexus letters.

Our purpose is to empower YOU, the veteran, to take charge of your medical evidence and provide you with valuable educational tools and research to guide you on your journey.

Understanding the unique challenges veterans face, our commitment lies in delivering exceptional service and support.

Leveraging an extensive network of licensed independent medical professionals, all well-versed in the medical professional aspects of the VA claims process, we review the necessary medical evidence to incorporate in our reports related to your VA Disability Claim.

Prestige Veteran Medical Consulting is not a law firm, accredited claims agent, or affiliated with the Veterans Administration or Veterans Services Organizations. However, we are happy to discuss your case with your accredited VA legal professional.