Last Updated on 2 August, 2025

For veterans receiving VA disability compensation, staying informed about annual rate changes is essential. In 2025, adjustments to VA disability pay reflect the latest 2.5% Cost of Living Adjustment (COLA) increase, ensuring benefits keep pace with inflation. Understanding how these updates impact monthly payments can help veterans plan their finances effectively.

This blog breaks down the updated VA disability pay chart, payment schedule, and how rating percentages, number of dependents, and Special Monthly Compensation (SMC) affect what you receive. You will also learn the future predictions for 2026 VA disability compensation rates.

Whether you’re a veteran or a dependent, knowing what to expect from the 2025 VA disability pay rates can make a significant difference for you.

Table of Contents

What is VA Disability Compensation for Veterans?

VA disability compensation is a tax-free monetary benefit to veterans who have disabilities resulting from diseases or injuries caused or aggravated during active military service. This monthly compensation can significantly increase based on the number of dependents, providing additional financial support to veterans’ families. Additionally, VA disability compensation aims to offset the potential loss of earning capacity due to service-connected conditions.

Eligibility Criteria for Veterans

To qualify for VA disability benefits, a veteran must have:

- Served in active duty, active duty for training, or inactive duty training.

- A disability rating for a service-connected condition.

- Been discharged under conditions other than dishonorable.

How VA Assigns Disability Ratings

The VA evaluates the severity of a veteran’s disability using the VA Schedule for Rating Disabilities (VASRD). Each condition is assigned a percentage rating in increments of 10%, ranging from 0% to 100%.

The VA reviews a veteran’s medical history, service treatment records (STRs), VA and private medical records to determine an accurate disability rating. This rating reflects the degree to which the disability impairs the veteran’s ability to work and perform daily activities.

For example, a veteran with mild asthma using an inhaler occasionally might receive a 30% rating.

Impact of Disability Ratings on VA Compensation

The assigned disability rating directly influences the amount of monthly compensation a veteran receives. Higher disability ratings correspond to increased compensation levels. For instance, as of December 1, 2024, a veteran alone with a 10% disability rating receives $175.51 per month, while a veteran with a 100% rating receives $3,831.30 per month.

Understanding the latest VA disability rates and the influential factors helps veterans ensure they receive the benefits they deserve.

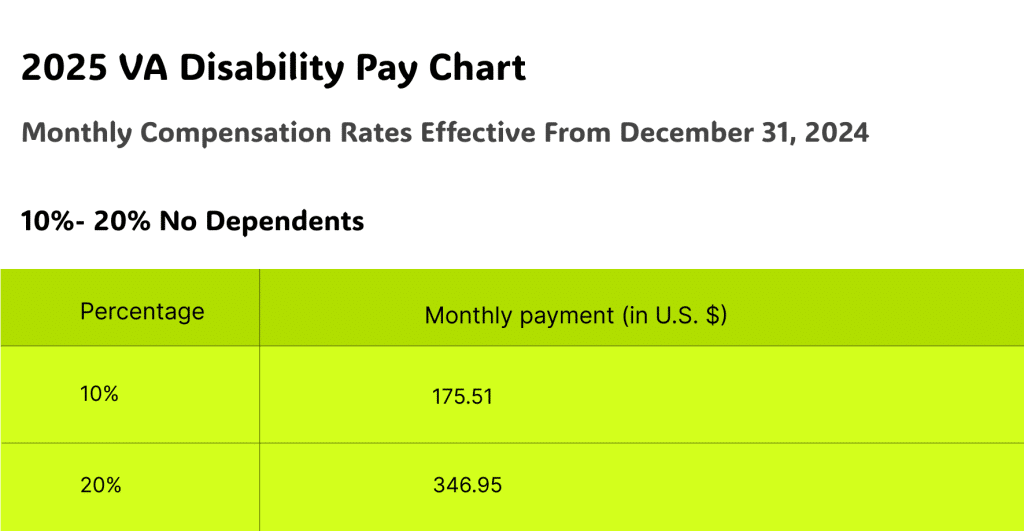

2025 VA Disability Pay Chart

Monthly Compensation Rates Effective From December 31, 2024

It’s important to note that the U.S. Department of Veterans Affairs has announced a 2.5% cost-of-living adjustment (COLA) for 2025. This increase took effect on December 1, 2024, and the first payment reflecting this adjustment was disbursed on December 31, 2024.

Following are the updated 2025 VA disability compensation rates aligned with a 2.5% COLA increase.

Source: VA Disability Compensation Rates

10% – 20% No Dependents

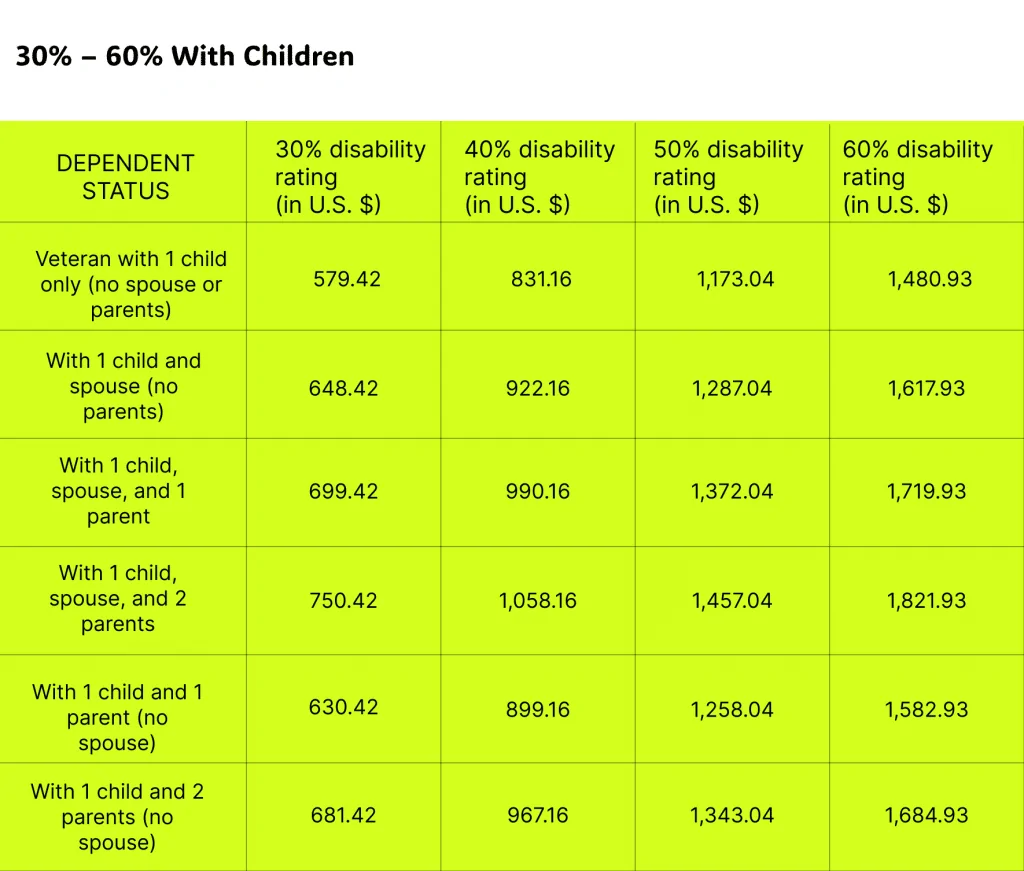

30% – 60% With Children

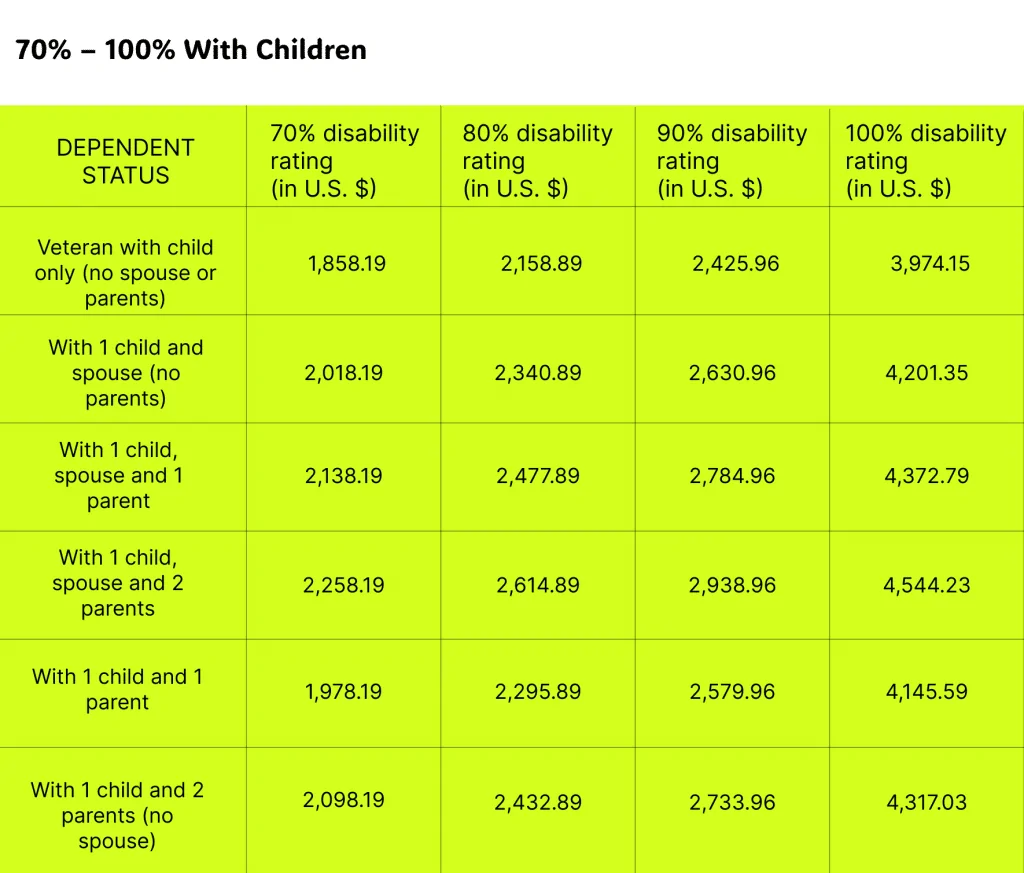

70% – 100% With Children

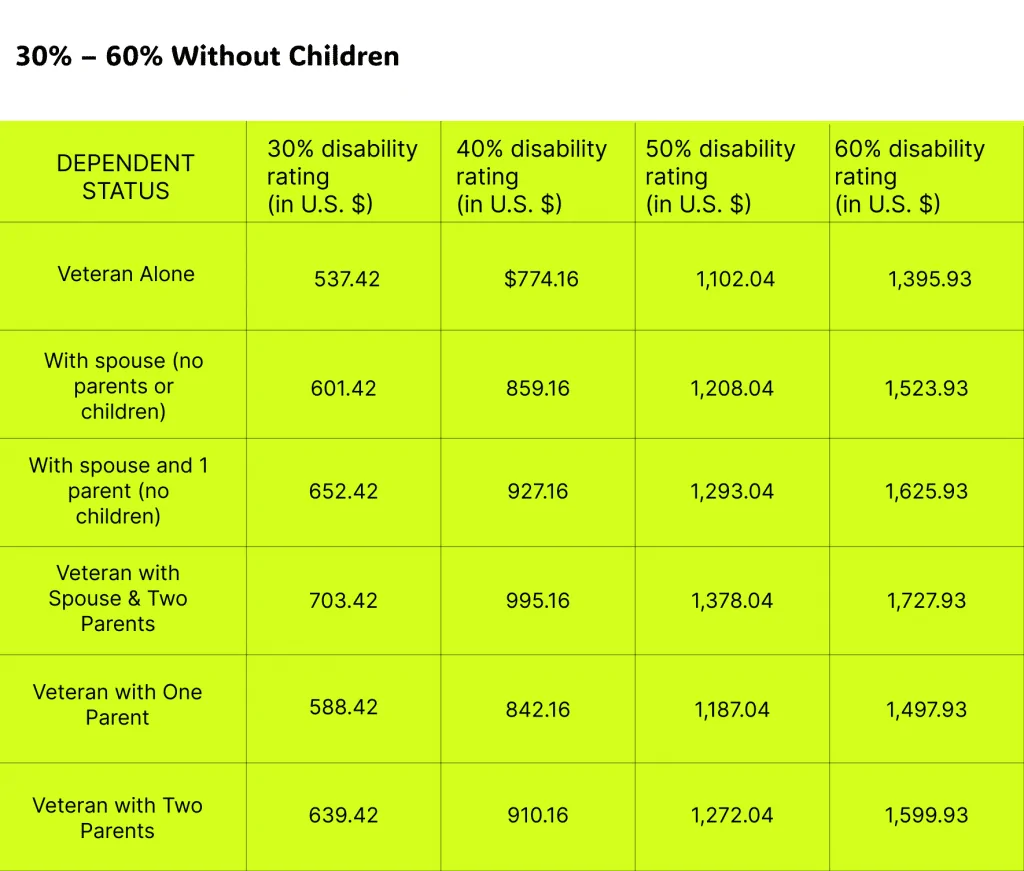

30% – 60% Without Children

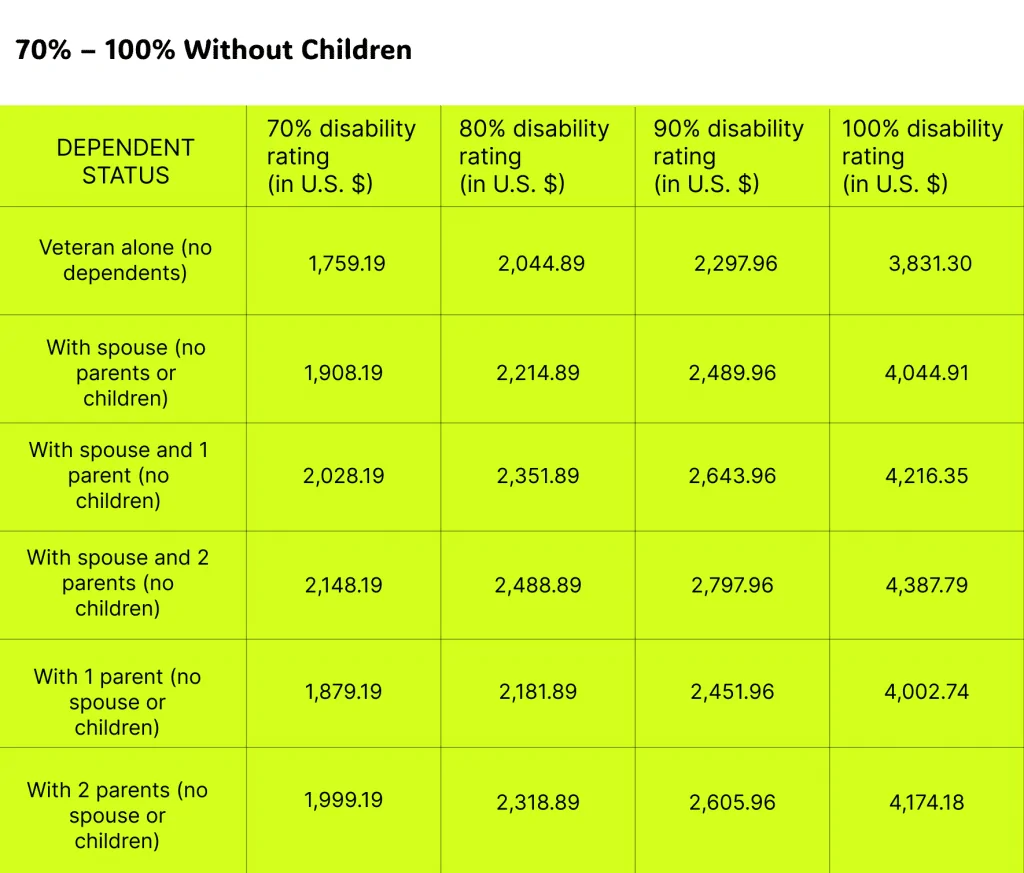

70% – 100% Without Children

Additional Amounts for Dependents

VA disability compensation includes additional amounts for dependents if the veteran has a disability rating of 30% or higher. The additional compensation is provided for:

- Spouse

- Spouse requiring Aid and Attendance (higher additional amount)

- Children under 18

- Children over 18 (if in a qualifying school program)

- Dependent parents (one or both)

The total compensation increases based on the number of dependents and the veteran’s disability rating. Veterans with a VA disability rating below 30% do not receive extra compensation for dependents.

How to Calculate Your 2025 VA Disability Monthly Payment Amount

To calculate your monthly VA disability compensation:

- Find your disability rating percentage (e.g., 50%, 100%).

- Identify your dependent status (single, married, children, parents).

- Use the disability pay chart to locate your base disability compensation amount.

- If applicable, add extra amounts for additional dependents or Aid and Attendance (A&A) eligibility.

For example:

- A veteran rated 80% with a spouse and one child receives $2,340.94 per month.

- If they have one dependent parent, they receive $2,477.86 per month.

- If the spouse qualifies for A&A, they get an extra $156.65 per month, bringing the total to $2,634.51.

By understanding these VA disability pay rates, veterans can accurately calculate their expected monthly benefits and ensure they receive the correct amount.

VA Disability Pay Schedule for 2025

The Department of Veterans Affairs (VA) disburses disability compensation payments on a monthly basis, typically on the first business day of the month following the month for which the benefits are due. If the first day of the month falls on a weekend or federal holiday, the payment is made on the last business day of the preceding month.

Here are the VA disability pay dates for 2025:

- January – Friday, January 31, 2025

- February – Friday, February 28, 2025

- March – Tuesday, April 1, 2025

- April – Thursday, May 1, 2025

- May – Friday, May 30, 2025

- June – Tuesday, July 1, 2025

- July – Friday, August 1, 2025

- August – Friday, August 29, 2025

- September – Wednesday, October 1, 2025

- October – Friday, October 31, 2025

- November – Monday, December 1, 2025

- December – Wednesday, December 31, 2025

Staying informed about the VA disability pay dates in 2025 ensures veterans can manage their finances effectively and anticipate when their disability benefits will be available each month.

Understanding Combined Disability Ratings

If you have multiple disabilities, the VA uses a combined rating system to determine your compensation amount. Instead of simply adding disability percentages, the VA applies each additional condition as a percentage of what remains of a whole person. The process follows a VA combined rating table, where the highest rating is considered first, followed by the next highest.

For example, if you have a 60% disability and add a 50% disability, your new rating isn’t 110% but 80%, according to VA calculations. This process continues until all disabilities are accounted for. Since 100% is the maximum rating, the VA ensures the total rating never exceeds that threshold, even when multiple severe conditions exist.

Applying for Total Disability Individual Unemployability (TDIU)

Veterans unable to work due to service-connected disabilities may qualify for Total Disability Individual Unemployability (TDIU), which provides 100% compensation even if your combined rating is below 100%.

To qualify for TDIU, you must:

- Have one disability rated at 60% or more, OR

- Have two or more disabilities with at least one rated at 40%, and a combined rating of 70% or higher

- Show that your disabilities prevent substantial gainful employment

- There may be other circumstances that qualify in some circumstances.

If approved, TDIU guarantees full VA disability benefits, including access to healthcare, compensation, and other VA programs.

What is the 2025 COLA Increase and How Does it Affect Disability Payments?

The Cost-of-Living Adjustment (COLA) is an annual change applied to various federal benefits, including Veterans Affairs (VA) disability compensation, to ensure that these payments keep pace with inflation.

This adjustment helps maintain the purchasing power of benefits as the cost of goods and services increases over time. When COLA rises, it increases VA monthly payout by a small percentage to help veterans and their families afford essentials like housing, food, and healthcare.

How COLA Is Determined Annually

COLA is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a measure of the average change in prices over time for a basket of consumer goods and services.

The Social Security Administration (SSA) compares the average CPI-W from the third quarter of the current year to the same period in the previous year. If there’s an increase, benefits are adjusted accordingly; if there’s no increase, the Cost of Living Adjustment remains unchanged.

For 2025, the Social Security Administration has announced a 2.5% COLA increase, reflecting the current economic conditions and inflation rates.

2023–2025 COLA Trends Explained

From 2023 through 2025, the Cost‑of‑Living Adjustment (COLA) shows a clear downward trend:

| Year | COLA % | Year‑over‑Year Trend |

| 2023 | 8.7 % | Massive spike amid inflation surge |

| 2024 | 3.2 % | Cooling inflation, still substantial |

| 2025 | 2.5 | Further decline to lowest in 5 years |

The sharp 8.7% increase in 2023 was largely due to high inflation and was the largest COLA in over 30 years. As inflation began to retreat in 2024, the COLA dropped to 3.2%. By 2025, inflation cooled further, leading to a modest 2.5% increase, the lowest COLA since the 1.3 % adjustment in 2021.

This steady decline reflects how COLA adjustments influence veterans’ monthly benefits and help them and other beneficiaries maintain their purchasing power over time.

For the latest information on Cost-of-Living Adjustments, visit the official SSA website at ssa.gov/cola.

How to Calculate 2025 COLA-Adjusted VA Payments

To calculate your COLA-adjusted VA disability payment, multiply your current monthly benefit by 0.025 to account for the 2.5% increase, then add that amount to your existing benefit to determine your new monthly payment.

Example: If your current monthly benefit is $1,000:

- Increase: $1,000 × 0.025 = $25

- New Monthly Benefit: $1,000 + $25 = $1,025

Note: COLA adjustments are automatic; veterans do not need to apply for the increase in VA disability pay.

2025 VA Special Monthly Compensation (SMC) Rates

Special Monthly Compensation (SMC) is an additional tax-free benefit provided by the Department of Veterans Affairs (VA) to veterans with severe service-connected disabilities.

Unlike standard disability compensation, SMC is designed for those who need aid and attendance (A&A) or have disabilities that warrant higher compensation due to their impact on daily life.

Eligible individuals include veterans, spouses, surviving spouses, and dependent parents.

SMC Rates for Veterans with Severe Disabilities

Special Monthly Compensation rates are assigned to different levels based on the severity of the disability. Here are the current SMC rates for a veteran with no dependents, reflecting the 2.5% COLA increase.

- Additive – An additional amount added on top of the veteran’s regular VA disability compensation.

- In-lieu – A replacement payment that is made instead of standard disability compensation.

| SMC Level | Monthly Rate (2025) | Type | Description |

| K | $136.06 | Additive | Loss or loss of use of limb, reproductive organ, blindness in one eye, etc.; paid in addition to standard VA disability compensation |

| L | $4,767.34 | In‑lieu | Amputation, blindness, or loss of use of limbs/extremities – replaces standard VA disability pay |

| L ½ | $5,014.00 | In‑lieu | Intermediate severity between L and M |

| M | $5,261.24 | In‑lieu | Conditions more severe than L, combinations of limb/eye loss |

| M ½ | $5,623.00 | In‑lieu | Between M and N severity levels |

| N | $5,985.06 | In‑lieu | More severe than M: major limb loss/loss of use, bilateral blindness conditions |

| N ½ | $6,337.00 | In‑lieu | Between N and O/P |

| O / P | $6,689.81 | In‑lieu | Most severe disabilities in L–O: multiple major losses or combinations; also labeled O/P |

| R‑1 | $9,559.22 | In‑lieu | Daily non‑medical aid and attendance (e.g. dressing, bathing) required |

| R‑2 / T | $10,964.66 | In‑lieu | Medical-level aid and attendance (R‑2) or traumatic brain injury requiring attendance (T); same pay rate |

| S | $4,288.45 | In‑lieu | Housebound (unable to leave home/facility) due to service-connected disabilities |

How to Qualify for SMC

Veterans may qualify for Special Monthly Compensation if they experience:

- Amputation or loss of use of a limb or organ

- Blindness or severe visual impairment

- Need for aid and attendance with daily tasks (eating, dressing, and bathing)

- Being permanently bedridden due to service-connected conditions

VA automatically considers SMC when evaluating disability claims, but errors can occur. Veterans should verify eligibility and ensure they receive the correct compensation. Additional payments are available for veterans with dependents, including a spouse, child, or parent requiring aid and attendance.

For a detailed breakdown, visit VA’s official website page dedicated to Special Monthly Compensation rates.

Additional Benefits for Disabled Veterans

Veterans receiving VA disability compensation in 2025 can access a variety of additional benefits beyond monthly payments. These benefits provide crucial support in healthcare, housing, education, and more. Below, we outline key programs available to disabled veterans.

Healthcare Benefits

The VA offers comprehensive healthcare services for eligible veterans, including free or low-cost medical care, mental health services, specialized treatments, and prescription medications. Those with a service-connected disability rating of 50% or higher typically receive priority access and free healthcare.

Additionally, VA facilities provide rehabilitation programs, prosthetic services, and caregiver support.

VA Specially Adapted Housing (SAH) Grants

Veterans with severe service-connected disabilities may qualify for VA Specially Adapted Housing (SAH) or Special Housing Adaptation (SHA) grants. These grants help fund the construction or modification of homes to accommodate disabilities, ensuring accessibility and improved quality of life. Eligible veterans can receive up to $117,014 in 2025 under the SAH grant program.

VA Education Benefits: GI Bill & Vocational Rehabilitation

Disabled veterans can use the Post-9/11 GI Bill or Montgomery GI Bill to pursue higher education, vocational training, or certifications. Additionally, the VA’s Veteran Readiness and Employment (VR&E) program provides personalized career counseling, job training, and resume-building assistance to help veterans transition into civilian careers. Survivors or dependents of 100% disabled veterans can receive Chapter 35 benefits to pursue higher education or training.

Property Tax Exemptions

Many states offer property tax exemptions for disabled veterans, reducing or eliminating their property tax obligations. Eligibility and exemption amounts vary by state, often depending on the veteran’s disability rating. Veterans should check with their state’s tax office to determine available benefits.

Travel and Auto Assistance Programs

The VA provides automobile adaptive equipment (AAR) grants for veterans with service-connected disabilities, helping them purchase or modify vehicles. Additionally, some veterans qualify for travel reimbursement for VA medical appointments.

Discounts on public transportation and specialized adaptive driving training programs are also available. Veterans and their families with a 100% disability rating are allowed to travel for free or at reduced cost with Space-A Program flights.

These additional benefits help enhance the financial and personal well-being of disabled veterans. Veterans should consult with their local VA office or a veteran service organization (VSO) to explore available assistance.

Importance of Medical Evidence

Medical evidence is the backbone of a successful VA disability claim, on which the VA will rely heavily to determine both the existence and severity of your condition. This includes:

- Service Treatment Records (STRs): These records establish a direct link between your condition and your military service.

- Private & VA Medical Records: These provide ongoing documentation of your disability and its progression.

- Nexus Letters: A nexus letter is an independent medical opinion that explicitly connects your disability to your military service. While these documents are never required, they can provide an additional layer of support in some circumstances. You may obtain a nexus letter from your primary care manager, a VA medical provider, or a medical expert familiar with reviewing these matters.

- C&P Exams: You may be asked to attend a Compensation and Pension (C&P) exam, where a VA-appointed medical professional evaluates your condition. Prepare by reviewing your medical history, listing all symptoms, and describing how the condition affects your daily life and ability to work.

Submitting lack of medical evidence, missing C&P exams, completing incorrect forms, and not filing appeals within the one-year deadline are some of the common mistakes veterans can avoid when filing a VA claim to prevent delays or denials.

How to Increase Your 2025 VA Disability Pay

If you believe your current VA disability rating doesn’t accurately reflect the severity of your service-connected condition, you may be eligible to request an increase and hence, receive greater monthly compensation. Higher ratings mean higher disability payments, often including additional amounts for dependents.

1. File for a Rating Increase

Use VA Form 21-526EZ or visit the VA’s regional office to file for a rating increase and show that your condition has deteriorated. Make sure to include updated medical evidence, such as recent VA or private treatment records, diagnostic results, and physician statements and impact on daily life and work.

Example: A veteran rated at 50% for PTSD may report increased panic attacks, missed workdays, or medication adjustments. A reevaluation with updated medical evidence might justify a 70% rating, increasing their disability pay from $1,102.04 to $1,759.19 per month in 2025 (no dependents).

2. Schedule a New C&P Exam

If you’re filing for a rating increase, the VA may schedule a Compensation & Pension (C&P) exam. Be honest, specific, and detailed. Keep a symptom diary to show worsening over time. Explain how your condition affects daily activities and employment.

3. File for Secondary Conditions

You can increase your VA benefits pay by claiming new secondary service-connected conditions caused by a primary condition. For instance, a service-connected back injury that causes sciatica or depression could lead to a higher combined rating.

Submit medical documentation, including a nexus letter showing the connection to secondary conditions in your VA claim.

4. Strengthen Claims With Nexus Letters and Medical Evidence

Providing strong medical documentation that ensures your VA rating better reflects your condition’s severity can lead to higher disability pay in 2025. For instance,

- Nexus letters written by a medical professional linking your current condition directly to your military service or an existing service-connected disability. This is especially important for secondary conditions or when the link between service and your illness isn’t obvious.

- Updated VA and private treatment records

- Lay statements from family or employers corroborating the impact of the condition on your life and work

Tip: Choose a provider experienced in VA claims. Organizations like Prestige Veteran Medical Consulting specialize in writing legally sound nexus letters.

5. Request for a VA TDIU Claim

If your disability prevents you from maintaining substantial gainful employment, apply for TDIU to receive the highest amount of compensation.

Example: Even if a veteran with 40% PTSD and 30% migraines have a combined VA rating of 60%, they still might qualify for 100% TDIU compensation if they prove job loss due to service-connected symptoms.

Increasing your VA disability pay rates in 2025 requires thorough preparation and persistence. Visit VA.gov to file or consult with an accredited Veteran Service Officer (VSO) to maximize their well-earned benefits.

What to Do If Your VA Disability Claim Is Denied?

If you disagree with your rating or your VA claim is denied, you have three appeal options according to the Appeals Modernization Act (AMA):

- Higher-Level Review: Request a senior VA reviewer to reevaluate your claim without new evidence.

- Supplemental Claim: Submit new and relevant medical evidence to strengthen your case.

- Board of Veterans’ Appeals (BVA): If the first two options fail, you can take your case to the BVA for a judge’s review.

Each appeal level has varying deadlines and requirements, so consulting a VA-accredited lawyer, claims agent, or Veterans Service Officer (VSO) can improve your chances of receiving fair disability pay.

How Appeals Timelines Affect Your Back Pay

Once your VA claim or appeal is approved, you may be eligible for back pay, compensation covering the period from your claim’s effective date to the approval date. The type of appeal you choose directly affects how quickly you receive this payment.

- Higher-Level Review or Supplemental Claim decisions typically take 30–90 days. Back pay usually follows shortly after approval.

- Board of Veterans’ Appeals (BVA) reviews take longer, often 1 to 3 years, but back pay is still calculated from your effective date and typically issued within 60–90 days of a favorable decision.

Key Tip: The effective date is usually the date VA received your claim. However, if you filed within a year of separation, it may go back to your discharge date.

To protect your earliest effective date, file VA Form 21‑0966 (Intent to File), submit a Fully Developed Claim, and appeal within one year of a denial.

Projected 2026 VA Disability Rates: 2.6% COLA Increase

Veterans receiving VA disability compensation in 2026 can expect to receive a 2.6% cost-of-living adjustment (COLA), according to estimates from The Senior Citizens League (TSCL). This increase, though modest compared to recent years, may continue the trend of above-average COLAs seen since 2022.

The VA disability COLA is tied directly to the Social Security COLA, which is calculated using third-quarter data (July–September) from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

How the 2.6% COLA Might Affect VA Disability Payments

If the VA confirms the 2.6% COLA increase for 2026, estimated monthly compensation for a veteran could rise as follows:

- 10% disability rating:

- Current: $175.51/month

- Increase: +$4.56/month

- 2026 Total: $180.07/month

- 100% disability rating:

- Current: $3,831.30/month

- Increase: +$99.61/month

- 2026 Total: $3,930.91/month

- Dependents:

- Compensation for eligible spouses, children, or parents will also increase by 2.6%.

Veteran Concerns

Many veterans and retirees argue this CPI-W measure fails to reflect their true costs of living, especially for older adults. A 2025 TSCL survey data shows 68% of older Americans support replacing CPI-W with the CPI-E, a more senior-focused inflation index that gives greater weight to healthcare, housing, and prescription drug costs. These expenses are often higher for veterans and the elderly.

While the 2.6% projected COLA for 2026 is above the historical average (2.3%), rising Medicare Part B premiums, estimated to increase by 11.5% next year, may offset much of the gain for many.

When Will the New VA Disability Rates Be Applied?

The 2026 VA disability pay rates will take effect on December 1, 2025, with the first boosted payment arriving January 1, 2026. Remember that the increase is applied automatically once the final SSA COLA is announced in mid‑October.

Disclaimer: Projected COLA figures are estimates based on current data and are subject to change once the official Social Security Administration announcement is made in October 2025.

2025 VA Disability Pay – What’s New from Last Year

- Cost-of-Living Increase: VA disability compensation rose 2.5% effective Dec 1, 2024, ensuring payments keep pace with inflation (down from 3.2% in 2024).

- Updated Monthly Rates: Payments now range from $175.51 for a 10% rating (no dependents) to $3,831.30 for a 100% rating (no dependents).

- Increased Dependent Allowances: Veterans rated 30% or higher now receive higher monthly amounts for eligible spouses, children, and dependent parents.

- Special Monthly Compensation (SMC): All SMC categories increased by 2.5%, with the highest level (R-2/T) now paying $10,964.66 per month.

- 2025 Pay Dates: Benefits continue to be paid on the first business day of each month, with early payment when the 1st falls on a weekend or federal holiday.

Learn how VA determines your disability rating: VA – About Disability Ratings

Conclusion

Understanding the 2025 VA disability pay rates ensures veterans receive the full benefits they’ve earned. With the latest COLA increase, these adjustments help keep disability compensation aligned with inflation, providing financial stability for veterans and their families. Knowing how ratings, dependents, and additional compensation impact payments allows for better financial planning. Whether you’re applying for benefits, seeking an increase, or navigating the VA system, staying informed empowers you to make the most of your disability compensation.

FAQs

What will the 2025 VA disability pay rates be?

The 2025 VA disability rates include a 2.5% COLA increase, adjusting monthly compensation based on a veteran’s disability rating and dependent status.

What is the VA payment schedule for 2025?

VA disability payments are made on the first business day of each month, with some months receiving early payments if the date falls on a weekend or holiday.

What is the COLA update for disability in 2025?

According to the Social Security Administration (SSA), the Cost-of-Living Adjustment (COLA) for 2025 is 2.5%, down from 3.2% in 2024 and 8.7% in 2023, marking the smallest COLA increase since 2021.

What are the 2025 VA disability rates?

Monthly VA disability rates increased by 2.5% for 2025 and range from $175.51 for a 10% rating up to $3,831.30 for a 100% rating for a veteran without dependents.

What is the maximum disability pay for 2025?

The maximum basic monthly VA disability compensation for 2025 is $3,831.30, paid to a veteran rated 100% with no dependents. However, qualifying for special monthly compensation can increase this amount.

What are the VA disability rates in 2025 with a spouse?

Here are the monthly 2025 VA disability compensation rates for veterans with a spouse only (no children or parents):

- 10% – $175.51

- 20% – $346.95

- 30% – $601.42

- 40% – $859.16

- 50% – $1,208.04

- 60% – $1,523.93

- 70% – $1,908.19

- 80% – $2,214.89

- 90% – $2,489.96

- 100% – $4,044.91

Can you get 200% VA disability?

No, the VA’s combined disability rating system maxes out at 100%, even if a veteran has multiple severe conditions.

Does the wife of a 100% disabled veteran get benefits?

Yes, spouses of 100% disabled veterans may qualify for additional VA compensation, healthcare, education benefits, and survivor benefits under VA programs.

How does VA disability affect Social Security benefits?

Receiving VA disability compensation does not reduce Social Security benefits. However, Supplemental Security Income (SSI), a need-based program, may be affected because it considers all sources of income, including VA disability, when determining eligibility.

How do I check my VA disability pay status?

Veterans can check their VA disability payment status online through the VA’s eBenefits portal or by calling the VA benefits hotline.

What can veterans expect for VA disability compensation in 2026?

Veterans can anticipate a projected 2.6 % Cost‑of‑Living Adjustment (COLA) increase in 2026, which would raise 2025 base rates (e.g. $3,831.30 at 100% becomes $$3,930.91/month). Additional increases may be applied to dependent allowances for those rated 30% or higher.

Also read: How to Find Nexus Letter Doctors Near Me: Practical Tips

At Prestige Veteran Medical Consulting, a veteran-owned company, we specialize in Independent Medical Opinions (IMOs) known as Nexus letters.

Our purpose is to empower YOU, the veteran, to take charge of your medical evidence and provide you with valuable educational tools and research to guide you on your journey.

Understanding the unique challenges veterans face, our commitment lies in delivering exceptional service and support.

Leveraging an extensive network of licensed independent medical professionals, all well-versed in the medical professional aspects of the VA claims process, we review the necessary medical evidence to incorporate in our reports related to your VA Disability Claim.

Prestige Veteran Medical Consulting is not a law firm, accredited claims agent, or affiliated with the Veterans Administration or Veterans Services Organizations. However, we are happy to discuss your case with your accredited VA legal professional.